Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up – China and India gained more than 1%. Europe is up across the board – half the markets are gaining at least 1%. Futures here in the States point towards a positive open for the cash market. This comes off a day the indexes gapped down and then grinded higher all day and got relatively close to their highs.

So far it’s been a pretty good week. The Dow is flat, the Nas is up 34 or 1.4%, the S&P is up 8 or 0.7% and the Russell is up 16 or 2.3%. All the indexes have made new highs this week.

I take a bottom-up approach to my research. That means instead of only looking at the S&P 500, I look at the 500 stocks within the index because the index is a derivative – it derives its value from its components. Looking at many charts last night leads me to the following conclusion: the market is in good shape, and although you never know what will happen in the near term, I feel confident the overall trend will remain in place.

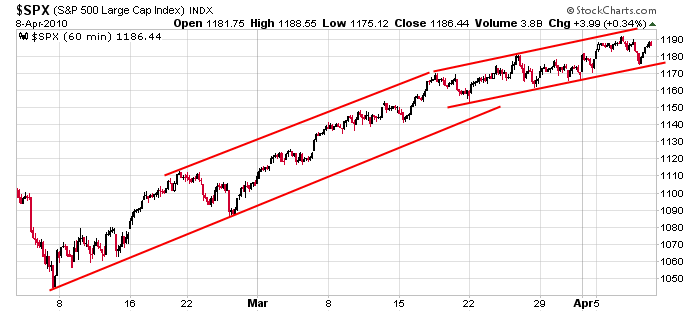

Here’s the 60-min S&P chart. The rate of ascent has lessened the last three weeks, but the ascent remains firmly in place.

News trumps the charts, and with earnings season starting next week (although it’s not a big week) be mindful of potential hiccups in the charts. Absent bad news, I expect the longer term trend is remain in place.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 9)”

Leave a Reply

You must be logged in to post a comment.

I would never look at all 500 charts in the S&P. thank you for doing it and thank you for sending these reports out. I like them a lot. Bill Dean

All 500? Well Jason, you definitely don’t have ADD.

What data feed are you using? I’d like to find a cheap tick or one minute with API.

The VIX can go lower , but it is at an extremely low level compared to the last several years , and I make note of it . The S&P topped about Oct. 9 , 2007 , and for those who have a good charting service , you might want to know where the VIX was on that day .

Thanks the video on breadth indicators . They seem to be in divergence , but still there is no pullback , yet I would not be surprized by one .

xkFT6T pldzjdsemmde, [url=http://mcjaxggurykd.com/]mcjaxggurykd[/url], [link=http://xujfbgpptsqm.com/]xujfbgpptsqm[/link], http://qhvyabjatmcx.com/