Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down – there were a couple 1% losers. Europe is currently down across the board. France, Germany and London are down more than 1%. Futures here in the States point towards a gap down open for the cash market. This comes off what felt like a weak day but thanks to a rally into the close, the final numbers weren’t horribly bad.

Here’s the 15-min SPX chart. Monday’s breakout didn’t get any follow through, and even though a new high was registered Tuesday, we continue to get stair-stepping movement instead of a traditional breakout. Near term downside support comes in at 1175.

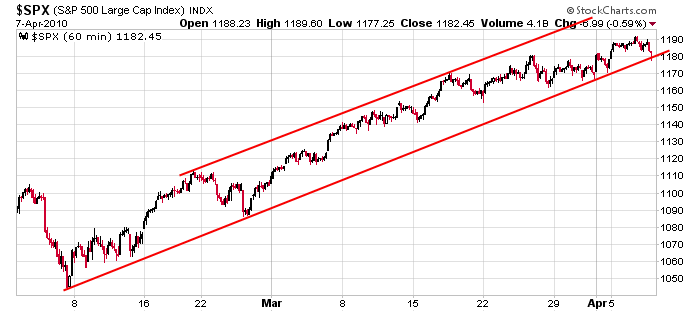

Here’s the 60-min chart. The trend remains up, and even if support is penetrated, it doesn’t necessarily mean the trend will end. The market could rest before moving up again or it may move up at a slower pace (150 SPX points in 9 weeks can’t continue forever) – from a mathematical standpoint, either would cause support to be taken out.

Near term the market is iffy. The proximity to resistance and weak volume Mon and Tues should be noted. Be careful. Long term I expect new highs to be made once again. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 8)”

Leave a Reply

You must be logged in to post a comment.

Going out on the ESMini limb; I think it just topped for the day.

I was wrong. Who’s buying these tops?