Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

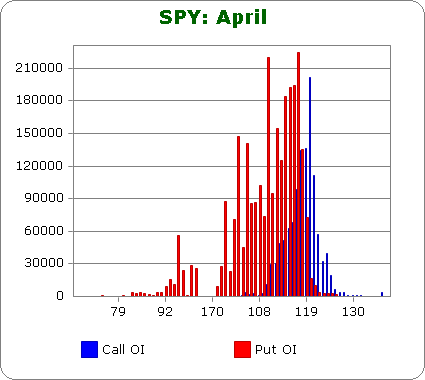

SPY (closed 119.74)

Puts out-number calls by 2.6-to-1, so there’s lots of bearish sentiment out there.

Call OI is highest between 118 & 121.

Puts OI is highest at 119 and below.

Given the dominance of puts, if we want to know what the market must do to cause the most pain, let’s focus on the puts and ignore the calls. With the stock closing at 119.74 today and put OI being highest at 119 and below, a flat market the rest of the week would expire all these puts worthless – a very painful situation for the bears who bet on a big downside move.

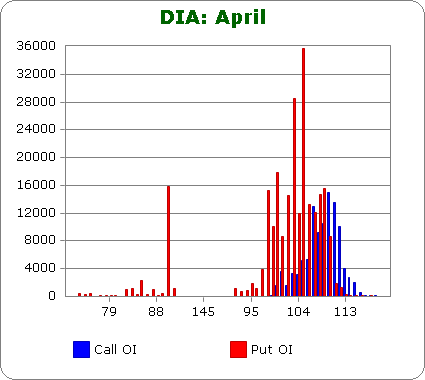

DIA (closed 110.18)

Unlike the last couple months where put and call OI was equal, puts out-number calls 2-to-1.

Call OI is highest between 107 & 112.

Put OI is highest at 109 and below with spikes at 103 & 105.

With overlap between 107-109 and puts outnumbering calls, a close in the upper part of that range or slightly above the range would frustrate the most number of people. The stock closed at 110.18 today, so flat-to-slightly-down trading this week will do the trick.

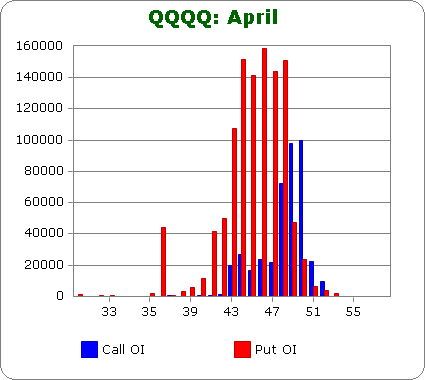

QQQQ (closed 49.07)

Puts out-number calls by 2.6-to-1.

Call OI is highest between 48-50.

Put OI is highest at 49 and below.

The zones overlap between 48-49, and since puts far out-number calls, a close just above this range will cause the most pain. With the stock closing at 49.07 today, a flat market the rest of the week is what’s needed to close the most number of calls and puts worthless.

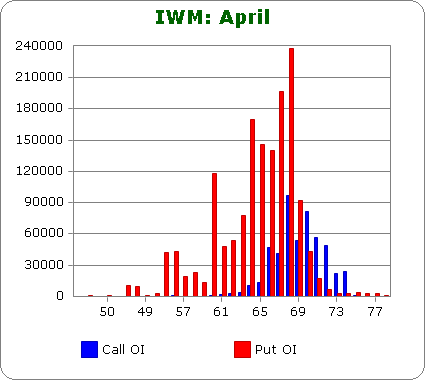

IWM (closed 70.54)

Puts out-number calls by 2.6-to-1.

Call OI is highest between 68-70.

Put OI is highest between 63-70.

Since puts far out-number calls, let’s focus on those to determine what the stock needs to do this week to cause the most pain. A close at 70ish would do the trick, and with the stock closing at 70.54 today, flat trading the rest of the week is what’s needed.

One more just for fun.

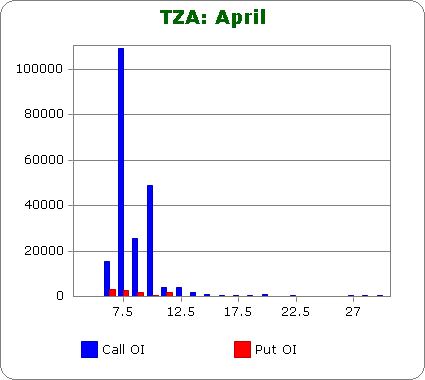

TZA (closed 6.35) – this is 3x inverse small cap ETF.

Call OI out-numbers put OI by almost 24-to-1, so lots of traders are betting on the market dropping (which would cause this stock to rally).

Call OI is highest at 7.5, 9 and 10.

Put OI is nonexitent.

Obviously a close below 7.5 would expire all those calls worthless, and considering today’s close at 6.35, the market would have to collapse for the call buyers to make money. A flat or moderate down market would cause the most pain.

Overall Conclusion: The bears have once again bet big on an expected move down. Given the put/call OI zones for each of these stocks and Monday’s closing levels, a flat market the next couple days will cause the most pain.

Jason Leavitt

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

Thanks Jase….puts into perspective the tape I am seeing and the obvious lack of movement. Lack of movement is the enemy of the active trader of course, so it appears as though trading will continue to be very difficult and time consuming.

Morning fade will likely be my only opportunity to get any trades in, so this means perhpas not a good week for scalpers in general. The alternative is to watch every 3 and 5 minute stick to look for nickels, very difficult work, do-able but tedious and frustrating sometimes.

wolverine

Jason great work!

Thanks for the analysis. Although it points to the markets closing flat, on the way to Friday, it could experience some volatility.

How many of those option writers have already hedged in the underlying? With appropriate futures contracts?

What’s that? You have no idea?

Oh… then I guess you can’t rely on this data to forecast diddly about the rest of the week.

When observed, Max Pain is an artifact of dynamic hedging.