Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down, but China moved up 1%. Europe is currently down across the board. Futures here in the States point towards a small gap down open for the cash market. This comes off an extremely slow day, which has become more and more common lately.

Traders are so relaxed, I’m sensing pent up energy that could explode at any time.

We’ve had numerous low volume days lately.

The McClellan Report noted yesterday was the quietest day since May 2007 (as measured by the intraday range).

Adam Oliensis of The Agile Trader notes the S&P 500 has closed above its 10-day MA for 38 consecutive days – the longest streak since 1972.

And I’m running out of things to talk about. This happens when the market keeps going and going and going.

Parabolic move up or quick correction – one of these is coming soon.

For what it’s worth, the Dow closed above 11,000 yesterday while the S&P did not take out 1200.

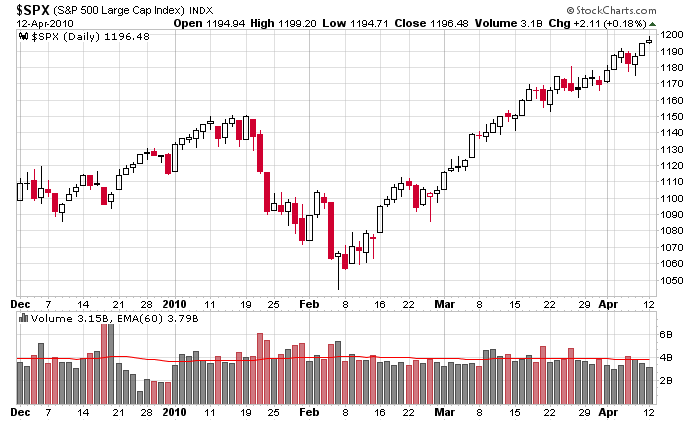

Here’s the S&P daily. Volume has fallen off the last three days as the index made a new high – not encouraging, but it’s been almost three months since the index has fallen three consecutive days. The bears can’t get traction for any length of time.

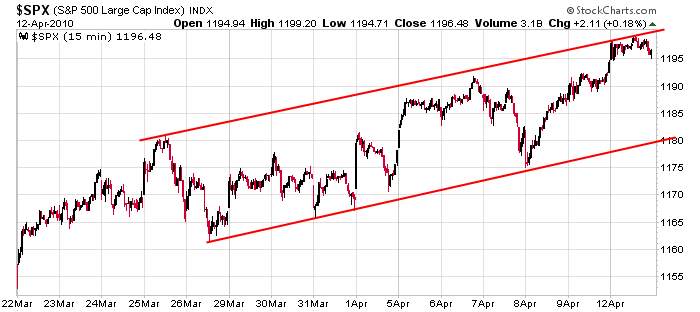

Here’s the 15-min chart. The top line is drawn parallel to the bottom – the index bumped up against short term resistance.

Given earnings season, it may take a couple days for the market to decide what it wants to do next. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 13)”

Leave a Reply

You must be logged in to post a comment.

Hi People!

To me, it looks like the calm before the storm.

Yes, the markets are always predisposed to some

sort of a ‘blowoff top’, but clearly any outside

exogenous force can topple this market really

at any time. HW

Leavitt Brothers always a good read. While the 15 min $SPX is up against resistance as they point out – suggest also getting some longer term perspective – take a look at a longer term – say “weekly” and draw a channel ( back to Jul 09 for bottom ) and it appears S & P is mid-channel, not at resistance . . .

This is not an exciting time to be a trader.

As crazy as it seems, it’s much easier to trade a market that goes up and down than a market that just keeps going up and up.