Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed with a bearish bias. Europe is down across the board – there are several 1% losers. Futures here in the States point towards a moderate gap down for the cash market.

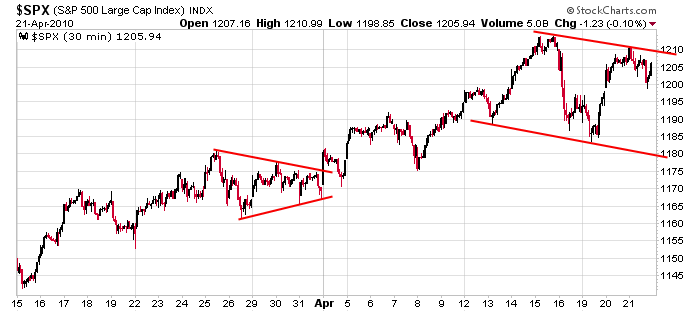

Coming off last Friday’s big down day, the market rallied Mon and Tues on declining volume and then churned in place yesterday. Here’s the 30-min S&P chart. Resistance has held. We have a falling rectangle pattern within an uptrend.

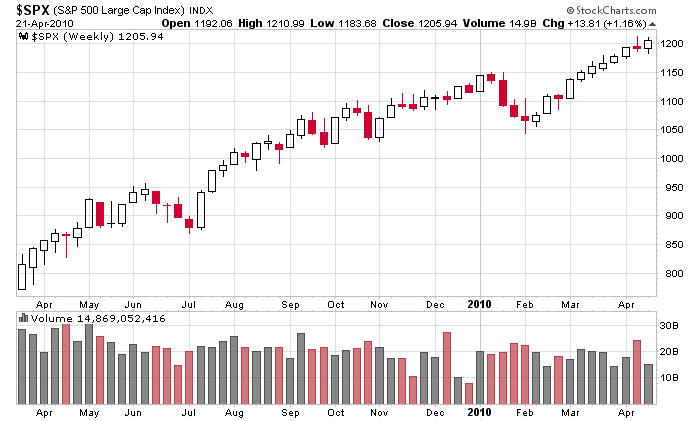

I still see nothing horribly wrong with the market. Greece’s financial situation is still a problem. Earnings season is here. We’re in that time period the market could let out a little air following options expiration. And there are a handful of indicators at levels that need to be worked off. All this and as of yesterday’s high the S&P was only a couple points from its high. Here’s the weekly.

Step one in trading is determining the trend. Step two is determining if the trend is young or mature – this tells us whether we should be aggressive or careful. Right now the trend is mature, and this keeps me in a conservative camp. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 22)”

Leave a Reply

You must be logged in to post a comment.

QQQQs high June 5, 2008 was 50.17. On April 15, 2010 it was 50.19; on April 21, 2010 it was 50.19.

Either we get a bounce down off that level which would be bearish or a break above which would be bullish.

The SPY/SPX is bumping into a rising trendline, so same story. We should know pretty soon