Good morning. Happy Wednesday.

Today will be a shortened day for me. I’ll be flying from south Florida back to Denver – not fun with two 18-month olds. And I won’t be updating the site unless something crazy happens while I’m away.

The Asian/Pacific markets closed mostly up – there were a couple 1% winners. Europe is currently mostly down. Futures here in the States are mixed.

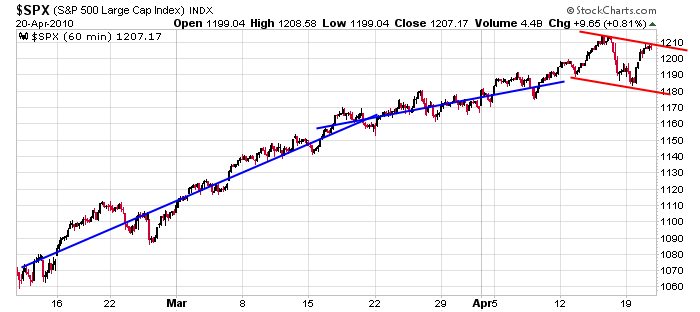

The market has done well to recapture most of last Friday’s losses. Volume was strong Monday but fell off yesterday. I see nothing hugely wrong with the movement. There are definitely some warning signs out there, but the trend remains solidly up. Here’s the 60-min S&P.The rate of ascent lessened in late March and early April, but the trend remained in place. Currently it can be said a bullish rectangle is forming, but a pullback is needed to solidify resistance.

I’m not smart enough to know what the market will definitely do; luckily you don’t have to be smart to recognize a trend and go with the flow. That’s most of what I do. I trade good stocks from the best groups in the direction of the trend. Trading isn’t any harder than that. Keep it simple. Research says more than half a stock’s movement stems from the overall market and another 25% is due to the group it belongs. Don’t try to out think the market. A stock can only go up or down, and you’re only looking for a slight edge to sway the odds in your favor. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 21)”

Leave a Reply

You must be logged in to post a comment.

Hi gang!

When I saw the earnings come out after the bell last

night (Apple, Yahoo), I thought we were going to

be off to the races today.

But apparently trading in Europe is pulling

down the opening futures this morning.

2) President Obama will be in NYC tomorrow

to lay the law down on those ‘nasty’ guys

from Wall Street. Is that just a little window

dressing to calm investor fears, or will

that be a ‘one, two’ punch when Bernanke

unexpectedly raises interest rates by

50 basis points after the bell on Friday.

Let’s wait and see. God bless, HW

“Research shows that half the gains are from the general market …”, what research are you referring to? Could you provide some pointers?

I have not crunched any numbers myself, but I’ve seen the stat is several unrelated places and can verify it with casual observation. When the market is strong, you could blindly buy a basket of 10 stocks and make money. If you focus those purchases in groups that are leading, you’d do even better. And of course within any group there are leaders and laggards, so go with the leaders and you’d be even better off. In fact you’d do just fine if all you had was a list of the best stocks in the best groups…and you wouldn’t even have to look at the individual charts.

Howard,

Look at the daily chart of AAPL. It’s gone parabolic and today’s gap up is something to watch as it relates to the Nasdaq 100 & NASDAQ Composite. AAPL appears to be the primary reason the NDX is positive today, but NDX hasn’t made new highs nor the Composite. If AAPL should finish today at the low end of its trading range, tomorrow could be interesting. A gap down in AAPL tomorrow would leave a daily “island top”, perhaps portending a top in NDX. A top in NDX could lead all the indexes down and signal the end of this rally – at least in the short term and perhaps even in the intermediate term since the NASDAQ indexes have been the strongest indexes. That’s a lot of “if” talk, but something to keep in the back of your mind. IF it happens, look for other technical indicators to confirm, including Elliott Wave.