Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Europe is currently down across the board. Futures here in the States point towards a moderate gap down open for the cash market.

Yesterday the Dow gained 1 point; the other indexes dropped 0.25%-0.45%. This doesn’t seem bad considering the previous week’s performance and close at new highs, but looking closer, the numbers were less encouraging. Almost one-third of the S&P 1500 (400, 500 & 600 together) registered a new 52-week high and almost half made a new 10-day high, but almost half the stocks closed in the bottom 20% of their intraday range. It’s not great when that many stocks make a new high and then turn around and close near their lows. Longer term this is irrelevant, but shorter term it suggests a little weakness.

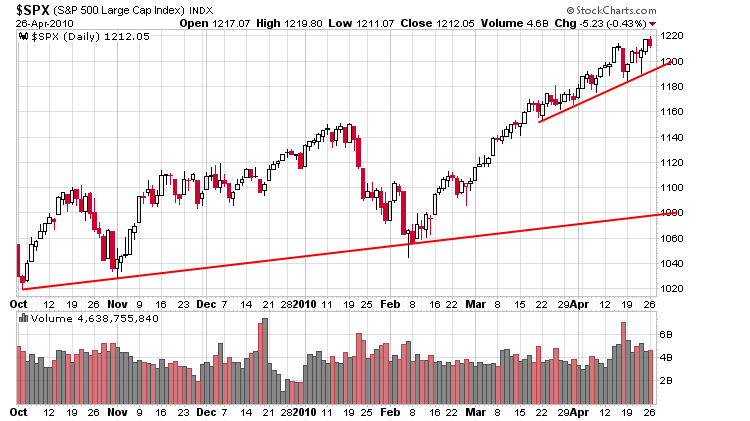

Here’s the S&P 500 – it did exactly what many stocks within the S&P 1500 did…make a new high and then close near its low.

As has been the case the last couple weeks, the trend is solidly up, and I expect new highs will continue to be made, but there are a few warning signs, so we need to be careful in the short term. So far the market has been able to ignore the warning signs. Sooner or later it won’t be able to. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 27)”

Leave a Reply

You must be logged in to post a comment.

Higher Highs with Lower Lows would be a megaphone pattern. What’s the psychological connotation? Are the long term buyers still buying, but the short termer’s are selling? Is short interest increasing?

Your reservations were well founded.

It is 3;30 PM and things have gotten messy. Personally I did some buying of selected things, but I think the ship will right itself and continue on for a time; until August sometime.

I am long dividends stock, bonds and trading scalps. I am intrigued by the PMs. Do you think they are likely to take off from this little base they have formed??

What’s a PM and wouldn’t trading scalps be scalping or a style of trading rather than something you trade?