Good morning. Happy Wednesday. Happy Fed Day.

With all of yesterday’s excitement, I forgot there’s an FOMC rate decision today at 2:15. The Fed has been irrelevant for several months, and I don’t see that changing now. They’re not going to move rates up; we’ll see if there are any dissenters.

For some reasons, yesterday was as bad as Friday the 16th. Only 6 total stocks from the S&P 1500 (400, 500, 600 combined) closed in the top 20% of their intraday range while 78% closed in the bottom 20%. That is very broad, across-the-board selling. The percentage of stocks trading above their 10-day MA dropped from 75% to 36%, and the A/D Line was 7/93.

The Asian/Pacific markets piggy-backed off the losses with across-the-board losses, and Europe is currently doing the same. Futures here in the States point towards a moderate gap up open.

As I’ve stated numerous times, I welcome a pullback; I want a pullback. I hate trading a market that just grinds higher day after day, week after week. I’d much rather see some up and down movement within an uptrend. Surges can be used to take profits and then pullbacks are used to allow the charts to reset for the subsequent rallies. So I’m hoping this isn’t another one of those brief and shallow selling episodes which immediately gets bought up. I’d rather get a 5-10% correction.

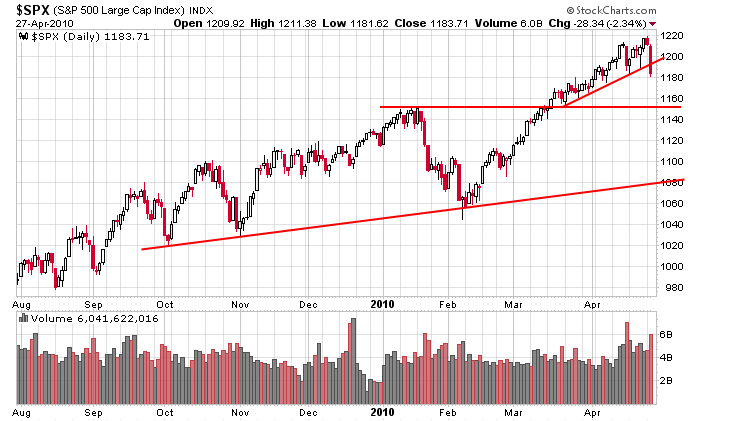

Here’s the S&P daily. A drop to the Jan high is very doable, but I’d love a correction all the way to the uptrend line. All indications are for new highs to be made again, so that second target may be asking for too much. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 28)”

Leave a Reply

You must be logged in to post a comment.

Hi gang!

I just made $358 dollars on a quick turn around trade

using Direxion TNA. The main problem is there is too

much premium built up in the premarket trading, so

invariably I ‘go with your gut’ is the best way

I know how to make money. And remember this:

1. Bulls make money

2. Bears make money and;

3. Pigs get slaughtered!

Regards,

HW

You want a 10% correction? Go stand in the corner!

Also, I didn’t get the Before the Open Email. Did you take me off the list?

Interesting article on the yield curve. When the Fed bailed out the credit market they acquired lots of debit. If the Fed unloads this debit at a discount then it will put a curve in the yield curve. Bottom line, the Fed may spin the yield curve in their favor. Duh, why else would you spin something? I’ve not heard back from the author, but my question is how much money is normally in each yield column on the yield curve and what is the percentage of the Fed loanables. Or, how much leverage does the Fed have?

No you weren’t taken off the list. Let me know tomorrow if you again don’t get it.

Will do.

You may get your 10% correction. See, standing in the corner works!