Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed – China lost 1.1%. Europe is currently up across the board – several markets are up more than 1%. Futures here in the States point toward a solid gap up open for the cash market. This comes off yesterday’s neutral day where not many stocks registered new 10- and 20-day highs and lows and an equal number of stocks closed in the upper 20% of their range as in the lower 20%.

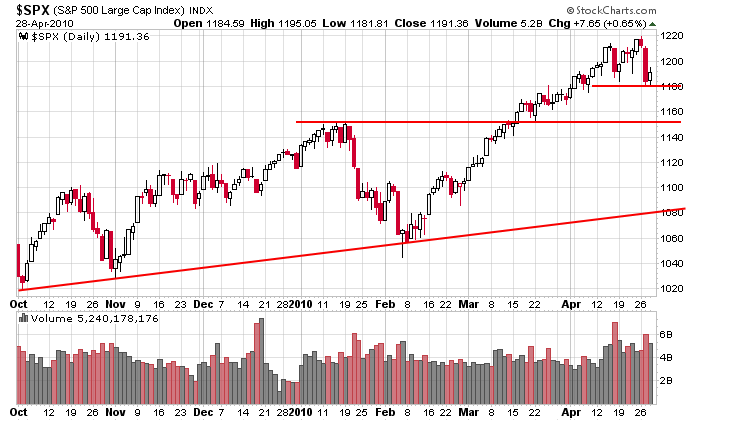

Over the last two weeks the debt of three European countries has been downgraded and yet the S&P is only 30 points off its high (as of yesterday’s close). To me this is a sign of strength. If the market was weaker, it would have gotten clobbered or at least put in a string of down days yet it’s been four months since the market has dropped more than two consecutive days. It’s still my belief the market is trending up and new highs will again be made. The question is whether we get a correction, and if so, how much of one.

Here’s the daily SPX. It might be consolidating; it might be topping. It’s impossible to tell what it’s doing – that’s why trading is a matter of odds, not certainty.

I ride trends. They are either new in which case I’m aggressive and use loose stop or they’re mature in which case I’m conservative and have a much shorter expected hold time. Right now the trend is mature; I’m waiting to see what comes next. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 29)”

Leave a Reply

You must be logged in to post a comment.

Hi Jason,

I am thinking we will see a small pop here but not to a new high. Just up a couple doys on lower volume. Then I think it heads lower and we will see a new downtrend develop.

I really like what your doing here. Excellent job! Alan Eckert

There is a trading philosophy which states the following:

” that stocks tend to rise at an above average rate in the two

trading days preceding each market holiday closing, as well as

on the last one or two trading days of each month and during

the first four or five trading days of each month.”

Next item:

2) I’ve got a short term target on

Nasdaq 100 at 2018 to 2025, and then

a retracement to the 1927-1943 area. HW

Nope, didn’t get the email this morning.

Hmmmm…I’ll double check the list.

You’re still in there. Perhaps the emails are going to a bulk or junk folder?

Just found out, new corporate spam filter. Oh well.