Good morning. Happy Thursday.

The Asian/Pacific markets closed down across the board. China lost 4%, Japan 3.3%. Europe is currently mixed with a bullish bias – there are no noticeable winners or losers. Futures here in the States are flat.

Long term the trend is solidly up. Short term the trend is down. Nobody knows if this is a simple correction within an uptrend or the beginning of something bigger. For now we’ll stay with our shorts and read the action day by day. Many indicators are pointing down and have room to move before being considered oversold. Even if we have a moderate decline similar to Jun ’09 and Jan ’10, there will be mini bounces along the way that can be used to add to positions or initiate new ones. Just don’t assume the market is going to completely fall apart.

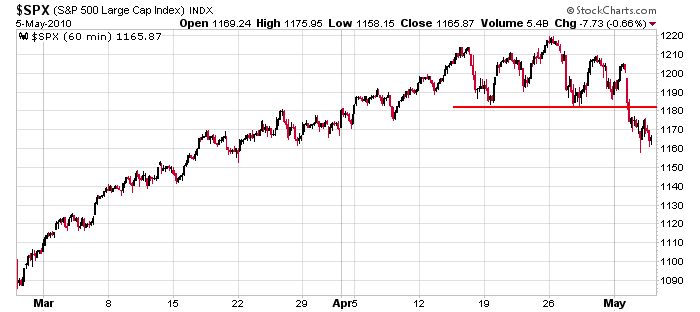

Here’s the 60-min SPX chart. Right now, sentiment and emotions are more meaningful than trendlines. It’s all about fear – the fear of losing money vs. the fear of missing a big move down. As long as the market is a little on edge, in my opinion, trendlines are less meaningful. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (May 6)”

Leave a Reply

You must be logged in to post a comment.

Jason I must agree 100%. I see a nice buying opportunity coming but it is not here yet.

Jason; why don’t you have a, ‘Guess the bottom’ contest. Give away three months service. My guess for the S&P emini is 1050.25.

Na…it’d be random dumb luck to guess a bottom. It not something I wish to promote.

voooooop voooooop 🙂