Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down – there were several 2 and 3% losses. Europe is currently down across the board – there are a couple 1% losers. Futures here in the States point towards a gap down open for the cash market. This comes off a very negative day where almost half the S&P 1500 registered a new 10-day low and decliners outnumbered advancers almost 23-to-1. All the indexes broke down from their consolidation periods. The long term trend remains up while the shorter term trend – the trend I trade off of – is broken.

I don’t make predictions, so I’m not going to say whether the market is going to drop 5% or 10% or test the Feb lows or test the March 2009 lows. I’d prefer to simply recognize the market’s direction and make sure I’m on the right side. Right now the right side is the downside. This should not be a surprise given the shorts and reverse ETFs that were added to the trading lists this past weekend.

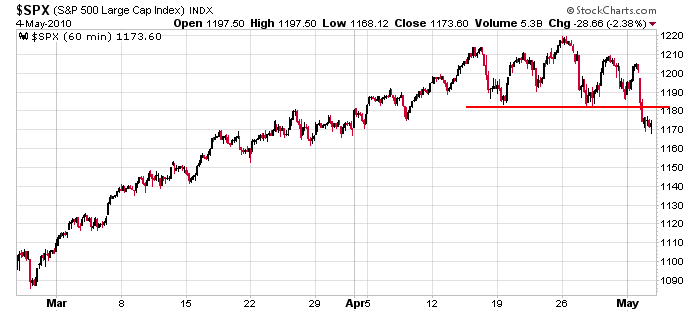

Here’s the 60-min SPX chart. Support has been taken out, but it’s not too far gone to reclaim the level. But follow through today will increase the need for a base before prices can make a significant move up. For now, bounces are shortable. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (May 5)”