Good morning. Happy Monday.

I was thinking last night the market was due for a bounce because the internals had fallen to extremely low levels. There are only 27 stocks within the S&P 1500 above their 10-day MA and only 51 above their 20-day – I can’t remember seeing readings that low…especially considering just a week before there were over 1000 stocks above their 10-day. On Friday, only 3 stocks made a new 52-week high and only 7 made a new 10-day high. And 3 of the last 4 trading days saw decliners out-number advancers by at least 10-to-1. Then I logged on to check the futures and saw they were up 40 – wow. I’ve see big gap downs when bad news hit, but I can’t remember such a gap up. Right now S&P futures are up almost 50 and Dow futures are up 370.

I’m not complaining, I love the movement – although a 50-point gap isn’t something I’m comfortable playing. All our shorts and inverse ETF trades hit their targets last Thursday and Friday, and I sit comfortably in cash in my trading accounts.

The reason for the gap up –>> Europe agreed to a nearly $1 trillion rescue plan and the US Federal Reserve said it would provide loans overseas. So what else is new – capitalize the gains, socialize the losses. Whether it’s AIG headed for bankruptcy or Greece following the same path, if they do well, they get to keep the money; if they don’t do well, the losses are spread out to everyone. Bad behavior continues to get rewarded, so there’s no sense following the rules or being responsible. I wonder what is being taught in top business schools.

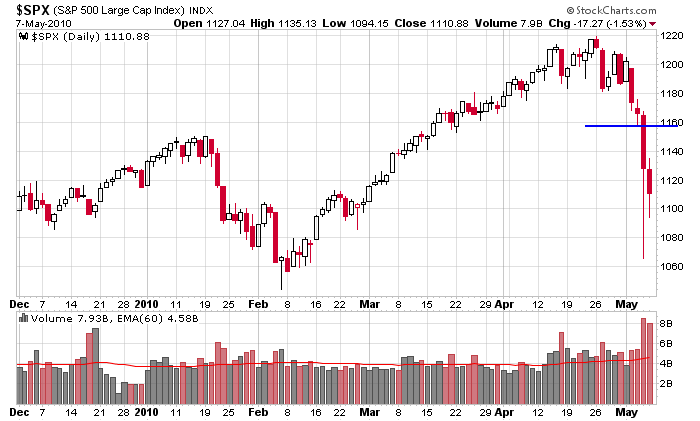

Anyways, as stated above I’m in cash and I probably won’t enter any trades just yet. My plan was to buy the inverse ETFs again when they came back down, but I didn’t think I’d have that opportunity at today’s open. I’m a technical trader who pays attention to market psychology, but news trumps the charts. Most news items are small and insignificant and have very little effect. The news of Helicopter Ben flying over Europe isn’t small and insignificant. Here’s the S&P daily. There’s no sense drawing trendlines. That blue line is where the index will open today (as of the futures indications right now).

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (May 10)”

Leave a Reply

You must be logged in to post a comment.

“Capitalize the gains, Socialize the losses” Good one! Needs to be on a T-shirt.

“When you’re right about being wrong, then you’re a trader.” Would be mine.

Nice job covering your shorts last Friday and going flat into the weekend…Gotta wonder if all your readers were so smart/lucky…Personally, I was a buyer both Thurs. & Fri. and loving it.

Thanks DonC…I even mentioned out the message board I was taking profits, but everybody has to make their own decisions.

Nice work on your buying.

Jason I am in your camp on this one. I was going in long with any weakness today but none came. When conditions are not right don’t trade.