Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down – there were a couple 1% losers. Europe is currently mostly down – there are also several 1% losers while Germany is up 4%. Futures here in the States point towards a sizable gap down open for the cash market. This comes off a massive gap up yesterday and relatively tight trading range. Today’s open will be near the low of yesterday’s intraday range.

The market either goes up, down or sideways. Heading into this week the odds favored more downside – even if there was a bounce first. But after yesterday, the odds are much less the market moves down. In fact I’d say the odds favor sideways movement (I’m talking about overall and over the next month or so, not the next couple days).

The market still has lots of stuff to sort out. The S&P lost 100 and recaptured all of it in less than 3 days. We’ve gotten huge intraday moves and big opening gaps. After nailing last week’s move down and cashing out on Thursday and Friday, I’m still of the opinion the market needs to calm down and find an equilibrium before better trade set ups surface.

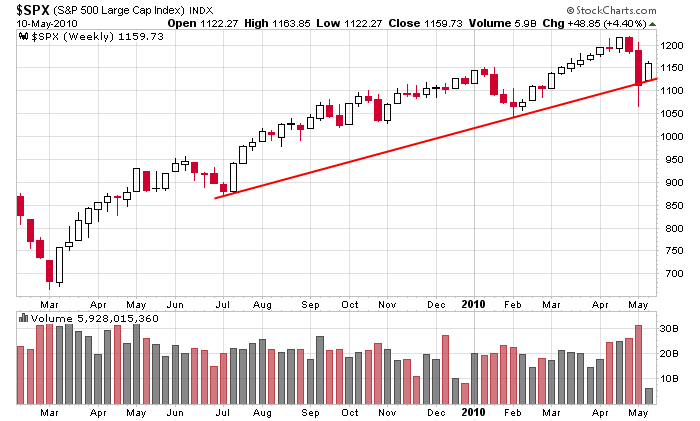

Here’s the S&P weekly. Other than the very brief spike down which was likely due to either human or computer error, the longer term trend could still be considered up.

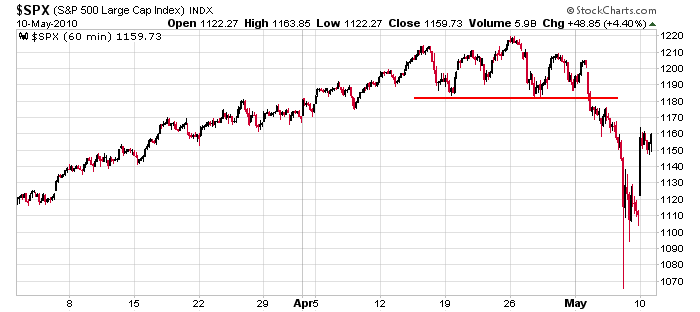

Here’s the 60-min. There’s lots of overhead resistance to contend with.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (May 11)”

Leave a Reply

You must be logged in to post a comment.

Jason,

The problem with this market (assuming one considers it a viable market) is that there is no way to hold anything overnight at present. Shorts that did that over the weekend were massacred……….by design. The market is at the mercy of the government manipulators and HFTers and I think a lot of small investors are wondering if these so called markets are a reasonable place to keep any money.

What’s an HFTer?

HFT = high frequency traders

The exaggerate moves, but in time the market is going to go where it’s supposed to go…JMO.

On a short term basis (next couple days, maybe the rest of the week), I agree with you, but things will eventually get back to normal.

Overall we could have 5 more years of sideways, up and down movement….perfect for trading. But and hold has been dead for 10 years. Gotta play the swings to make money.

The truth is when you wake up at 3am EST and see how

Europe is trading, that more or less sets up the

trading day for the U.S. markets. HW

Post your thoughts, “The 3AM Report”

An HFTer is a High Frequency Trader using the machines to front run and manipulate the market. BTW Howard, it does not matter what Europe does if the market gaps 350 points.

I agree…the correlation between the US and Europe isn’t strong enough to base decisions on.

Thanks

I was just wondering. Whether we the lesser mortals, will ever know what really caused that massive 1000 point drop in Dow? Many stories are being circulated blaming one or other. But will the Govt. ever care to tell the truth?

How would knowing the truth change anything?

We’ll probably never know, but in my opinion, it was not an accident or error.

Now that leaves intentional or act of god.

I believe in strict separation of church and market. 🙂

Jason after Mondays gap up bounce I would not even begin to call this market.