Good morning. Happy Wednesday.

The Asian/Pacific markets mixed. The closing levels suggest a relatively quiet day. Europe is up across the board – there are a couple 1% gainers. Futures here in the States point towards a flat open for the cash market.

Other than Monday’s open, we’ve had two calm days in a row and little net change from Monday’s opening tick. Soon we should get some answers to some lingering questions. The market was weakish before last Thursday’s induced collapse. Should we ignore the collapse and consider the weakness to have been innocent selling within an uptrend? Or… Now the market has been recovered the losses. Shorts no doubt helped keep the indexes at the current level the last two days, but they have certainly covered by now or won’t cover. Without support from them, are there enough buyers to keep prices up? After all the first surge off a low is easy because of short covering and perma bulls who are bottom fishing. But those groups aren’t enough to keep things aloaf very long. Others, especially institutions, need to join in. Soon we’ll find out.

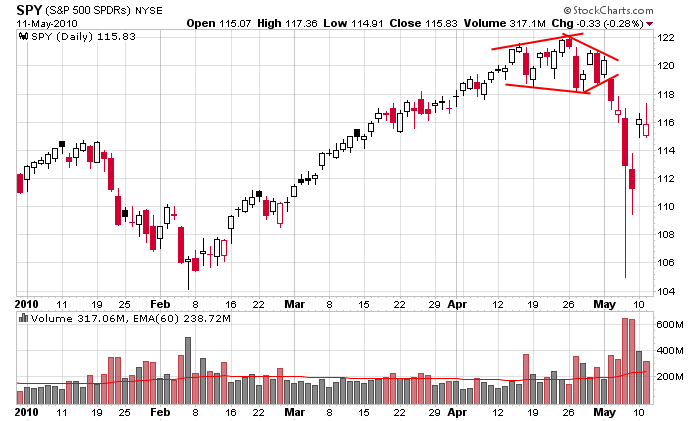

Here’s the SPY daily. I use it because it shows gaps better than the SPX. Right now trendlines are meaningless. There’s too much emotion and news jerking the market around. A chart is supposed to be the sum total of everything going on – assuming there aren’t major news items that are temporarily influencing support and demand. Such is not the case right now. We need a few more days for things to calm down before traditional charting techniques have meaning again. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (May 12)”

Leave a Reply

You must be logged in to post a comment.

I really like your candid analysis of the markets. When you don’t know, you say so. You raise points that I miss and you get right to the point. You really do this analysis well.

Thanks….being objective is the only way I know how to do things.

Why should one worry about real buyers (human traders) as long as HFT computers are front running the orders of human beings? Will the actual buyers ever matter now?

HFT sells just as much as they buy…they account for a lot of volume, but I’m not sure they account for much overall movement. They are usually in and out pretty quickly.

This is starting to sound like Terminator. Man against machine.

I don’t look at it that way. My biggest opponent is me, not some machine. If I wish to buy a stock at 50 and sell at 54, it doesn’t matter if I get in at 50.1 as a result of a computer front running my order.

If you scalp, those extra nickels and dimes matter. If you ride swings, a little extra slippage doesn’t matter.