Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets got hit hard. Several indexes dropped more than 2%; China took a 5% beating. Europe is currently mostly up. Futures here in the States point towards a positive open for the cash market. This is quite a turnaround compared to several hours ago when futures were trading much lower.

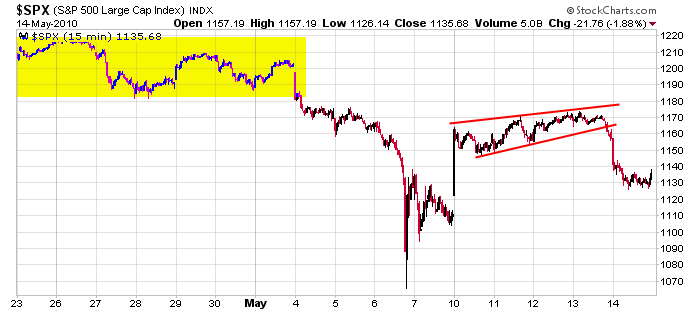

There’s no need for me to repeat what was written over the weekend. The market got a big boost last Monday from the European bailout news but closed below Monday’s gap up open level on Friday. The bottom of April’s consolidation period proved too tough to penetrate and now last week’s high will be another layer of overhead resistance.

Here’s the SPX 15-min chart. 1180 remains resistance from April, and now the mid 1170’s is also resistance.

The first big drop caught some by surprise and created some bag holders who committed to selling if given another chance. The second drop certainly got the attention of those who fell asleep at the wheel the previous week. They now are bad holders too; they’d love to sell if given a chance near last week’s high. But this type of analysis only matters until the next big piece of news emerges from Europe. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (May 17)”