Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed with a slight bullish bias. Europe is currently up across the board – there are several 1 and 2% gainers. Futures here in the States point towards a moderate gap up open for the cash market. This comes off a day where the market was weak early and then grinded up the rest of the day to close near its high. The internals were strong but not strong enough to make me think a give-back was imminent.

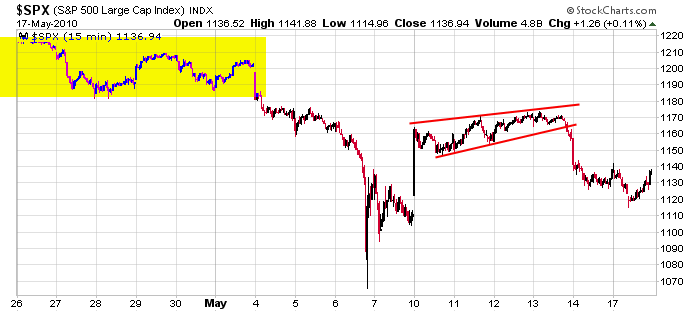

Here’s an update of the 15-min SPX chart. On a short term basis, yesterday’s low could be considered a higher low which is a good first step, but there remains a lot of overhead supply to deal with. There are many bag holders who’ve been spooked by the events of the last two weeks and would love a chance to sell up near that consolidation zone.

Today after the close I’ll do my monthly Put/Call Open-Interest write-up. At first glance it looks like the put buyers will actually make some money this month – assuming the market doesn’t move up much the next couple days.

My intermediate term bias remains to the downside. There’s too much overhead supply to tackle at once. At the very least the S&P will struggle in the 1160-1180 area – if it gets there. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (May 18)”