Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed with an upward bias – China gained 3.5%. Europe is currently trading down – there are no big losers. Futures here in the States point towards a moderate gap down open for the cash market.

I don’t have anything to add to the report I wrote over the weekend. Near term (the next couple days) the market may bounce, but technically it’s broken and barring significant progress in Europe I would not expect a bounce to last long or go too far. I’m sure others are thinking the same thing – this heightens my senses. Perhaps it’ll go a little further than expected to surprise many traders.

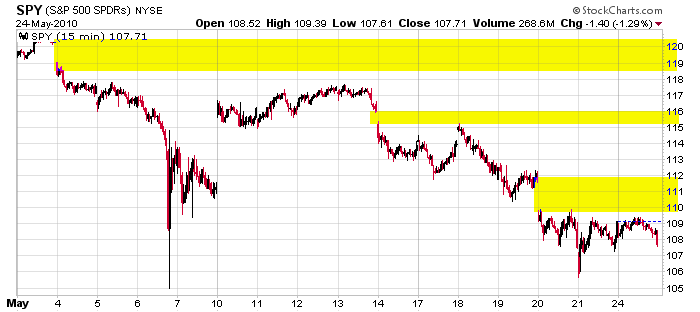

Here’s the 15-min SPY chart with three large unfilled gaps highlighted.

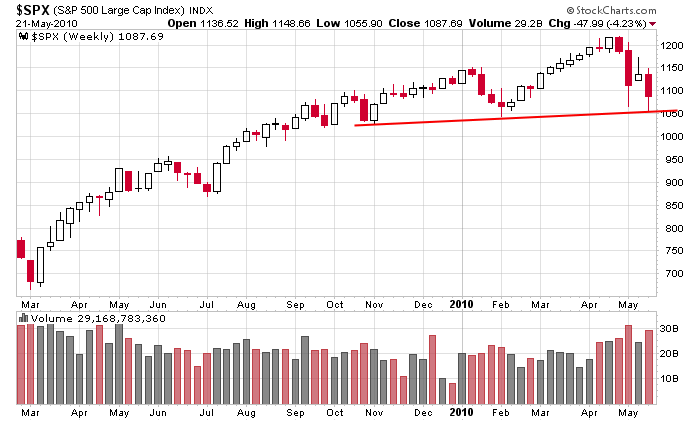

Here’s the weekly SPX – a possible head-n-shoulder top is forming. Let’s not assume the market is about to completely fall apart.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (May 24)”

Leave a Reply

You must be logged in to post a comment.

if it’s a “head-n-shoulder” than we should have right shoulder on the chart, so in coming few weeks we may see some bounce to levels below 1200 or something

From IVolatility Trading Re: E-mini S&P 500 Index

…based upon preliminary numbers, Fridays reversal qualifies as a key reversal, implying it will make a higher high on Monday and will most likely continue higher for several more days.

In addition, to the e-mini there were key reversals in many other broad market and important sector indices including the iShares Russell 2000 Index (IWM), iShares MSCI Emerging Markets Index (EEM), Consumer Discretionary Select SPDR (XLY), and the iShares DJ Transportation Index ETF (IYT).

The chances are now very good equities will continue higher for the next few days or even weeks.