Good morning. Happy Tuesday.

It’s not such a happy day for world stock markets – they’re tumbling. The Asian/Pacific markets suffered big, across-the-board losses…several fell more than 3%. Europe is currently getting clobbered. Futures here in the States point towards a huge gap down for the cash market. Today’s S&P open will be below Friday’s gap down open and not very far from February’s low. What took three months to gain has barely taken three weeks to give back.

I’ve said several times if you find yourself hoping for a bounce to get short, it probably won’t happen. That’s how bear markets work. They don’t give you a second chance to get short. They just fall day after day and before you know it, the S&P is down another 100, and you’re sitting watching. That’s why I’ve said I will maintain short exposure during the entire process. If the market bounces, fine, I’ll add to my positions. If the market falls apart, at least I have some exposure.

In many cases, the internals are as bad as they were at the March 2009 low. The difference is March 2009 came after an extended 18-month downtrend. The currently downtrend has only lasted four weeks – it may be just getting started.

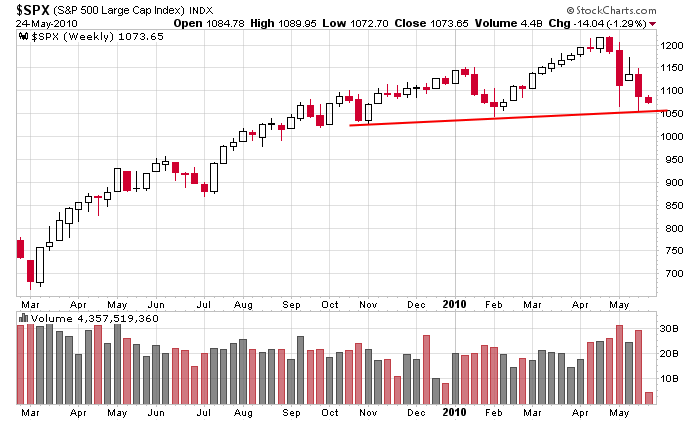

Here’s the S&P weekly. If it’s gonna bounce, today’s open near the trendline drawn would be a good place. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (May 25)”

Leave a Reply

You must be logged in to post a comment.

Good post, Jason. The psychology has completely changed from buy the dips to sell the rallies. People are praying for it to go up so they can short it. Rallies are now all short covering rallies. Who knew that you couldn’t print your way out of this mess? But we can’t get complacent. The Plunge Protection Team could take a stand to try to crush shorts.

Hi Jason,

I had mentioned back several weeks ago that when you were still Bullish that the market was in a topping process and going to head lower, disagreeing with your thoughts at the time. My reasoning was strictly from technically reading the charts and indicators I follow.

So today we get a large gap down at the open. That is fine but there is a Head and Shoulders building on the NDX 100 and others. In my opinion, I think the NDX will now undercut the Feb. 2010 low setting a new lower low, then rally back up to resistance somewhere between 1850 and the 1930 area. This should develope the right shoulder, and at that point I would Short the market. It is likely the last chance before the next big decline coming this summer and fall. There will not be more rallies to new highs for some time. That idea can be put to bed for now at least in my opinion. I think we will test the March 2009 lows. Then another rally will start, however, if that rally is short lived, then the 2009 low could be taken out. But that is looking out aways and I don’t want to get ahead of myself. Maybe we will just see a final bottom at the test of the March 2009 low, but my gut tells me things are going to get allot worse than most people think. Everyone is Hopeing, but this time I think hope will turn more into Fear. Anyway, that’s my rant for this post. Have a great day! Alan

I follow the S&P 500 much closer but I am looking for a scenario very similar to Alan’s. Current drop ends just above 1000…..followed by a rise to 1075-1100 and then another move down to the SPX 925 range.

I think Alan makes some valid observations. A close (particularly a FRI weekly close) below the FEB daily closing low (around SPX 1054) would confirm that the longer term trend is down. Fibo retracements are roughly in the 875 to 950 area and that’s where we would likely be headed. Elliott Wave is showing 3rd wave characteristics. The open question is, what degree of that 3rd wave are we experiencing? But who cares? “The trend is your friend” and it’s pointing down! Sell rallies that fail at the 200 day MA, in my opinion.

By the way, I wouldn’t wait too long for that right shoulder to form. It may not happen if the FEB low is broken. Did I mention how critical it is for the bulls (or the PPT) to hold the FEB low? This is an important week for the bulls as well as the bears centering around the FEB low!

vooooop voooooooooooppppp 😉