Good morning. Happy Wednesday.

The Asian/Pacific market closed mostly up – there were several 1% winners. Europe is flying – most indexes are up 2-3%. Futures here in the States point towards a moderate gap up open for the cash market. This comes off a second big reversal day in three days. Everyone thought the market was due for a reversal on Monday, but in typical market fashion, it looks like the reversal has been delayed two days – just enough time to frustrate the bulls before a real move can begin.

It won’t be clear sailing. There’s a lot of overhead resistance in the form of bag holders who’d love a chance to get out even, and sentiment has been so bad, it’s been an entire month since the market has put in consecutive up days. But many of the indicators fell to levels not seen since the March 2009 bottom, and it’s at times when things look the nastiest that the supply demand imbalance can shift.

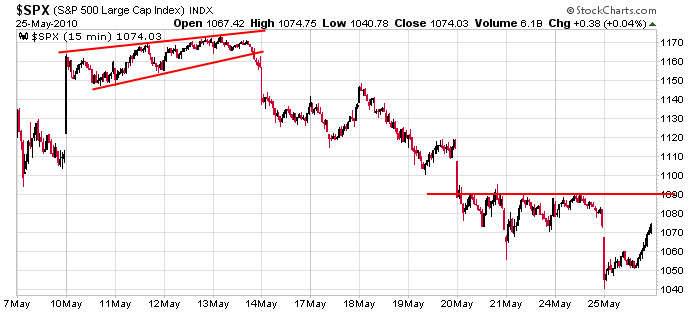

Here’s the 15-min S&P chart. The first tough hurdle to conquer will be 1090. After that 1120.

For now I’m treating this like a bounce within a downtrend. The first couple up days are easy. There are always bottom fishers and of course the shorts scramble to cover. So for me to believe a move up has staying power, there needs to be strong buying interest beyond the first couple days. You never know. The market may move sideways in a range for the next couple months. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (May 26)”

Leave a Reply

You must be logged in to post a comment.

You could throw a dart at the chart and hit a point of credible resistance, a lot of pockets in that one.