Good morning. Happy Tuesday. Hope you had a nice long weekend.

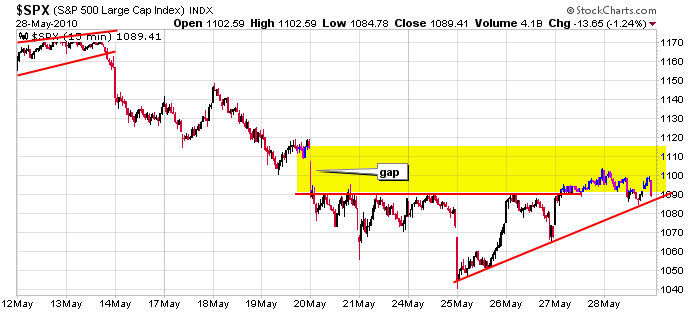

The market put in a productive day last Thursday by gapping up and moving up all day to close at a 6-day high. But part of the gains were given back Friday and another chunk will be given back at today’s open with a big gap down.

The market has been alternating between closing up and closing down and has still yet to put in consecutive up days since the end of April.

The Asian/Pacific markets closed down across the board today – there were many 1% losers. Europe is currently down across the board – most indexes are down 1.3-2.8%.

The Euro hit a new 4-year low. Hewlett-Packard is cutting 9,000 jobs. Oil is down.

I’ve said numerous times the last couple weeks the normal forces of supply and demand are not in play and therefore trendlines drawn on the charts are not as useful as they typically are. There’s too much stuff going on in the world for me to think the penetration of a trendline will lead to a quick move and follow through. The conditions continue to be heaven for day traders and frustrating for swing traders because of the big gaps and random moves in both directions.

Here’s the daily SPY. Today will be the third time in seven days the market is gapping down big. Will it fill the gap like the previous two? We’ll see. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 1)”

Leave a Reply

You must be logged in to post a comment.

today is tuesday

ooops