Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Europe is currently mostly down, but losses aren’t great. Futures here in the States point towards a moderate gap up open for the cash market. This comes off a day where the market was weakish most of the day and then fell apart into the close.

The overall sentiment is bearish and trend is down, but day to day anything goes given whatever news hits the market and whether market participants are in the mood to absorb and ignore it or have an extreme knee-jerk reaction to it. The breadth indicators are acting as if the market is undergoing a change, so for now my opinion stays the same. Bounces are shortable.

The index charts don’t look good, and per the key group charts we checked out yesterday, I don’t see any hidden strength brewing. To expect a couple groups to turn around and move up is reasonable. To expect all groups to suddenly turn around and move is asking too much absent a horrific sell-off which completely breaks the back of the bulls.

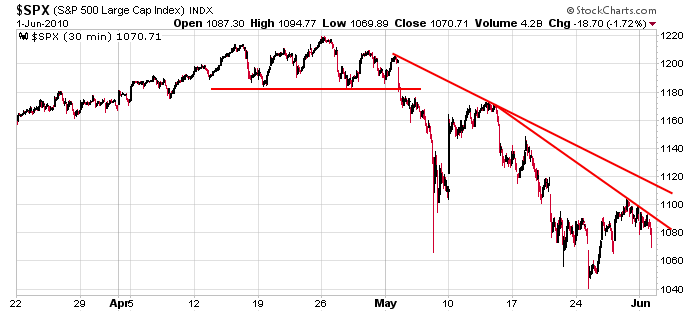

Here’s the 30-min SPX chart. There isn’t much to like here, and the situation isn’t bad enough to expect a washout soon.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 2)”

Leave a Reply

You must be logged in to post a comment.

So it seems to me a back test of

S&P 1102-1105 is in the cards.

Anything north of that is possible,

so it’s a wait and see game right now.

howie, u were on that one.