Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Europe is currently down across the board. Futures here in the States point towards a small gap up open for the cash market.

On a closing basis, the last two days combined have been worse than any other two days since the market topped. On Friday, 1230 of the 1500 stocks in the S&P 1500 closed in the bottom 20% of their intraday range. Yesterday the number was 1271. Not only are these the two worst days since the top, they’ve come back to back and suggest a relief bounce should materialize soon.

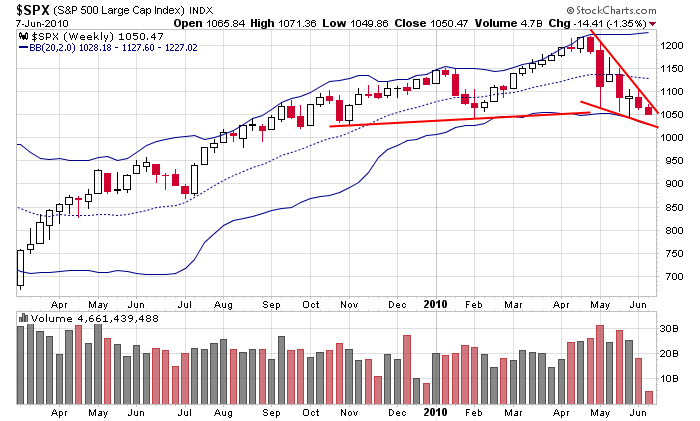

The most bullish picture I can paint is that of the S&P possibly forming a bullish wedge at support (1040-1050) and at its lower Bollinger Band.

But with the indicators acting as I’ve pointed out numerous times the last month, the overall trend, in my eyes, is down, so I’m maintaining my short bias.

Know what time frame you’re trading. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 8)”

Leave a Reply

You must be logged in to post a comment.

Any thoughts on the pattern so far this year being a “head and shoulders” pattern, with the left shoulder being formed in early Jan @ 1150, the late April 1220 level being the head, and now a possible bounce back to the 1125 – 1150 level to form the right shoulder. I know it’s not technically a head and shoulder pattern until it’s done, but just curious as to your thoughts. (might play out if your “bullish wedge” mentioned above were to happen)

I personally think head-n-shoulder patterns are among the worst and least reliable, so I pay no attention to them.

Jason, could you add a bottom feeding indicator to the 20%? Something that would indicate bottom feeding.

Thanks

For example?

I’d rather use a washout to indicate a bottom…anything that suggests bottom feeding suggests a lack of fear and more downside.

I guess I don’t understand the term, “bottom feeding”.

I don’t often disagree with you often Jason but I think we may have seen the bottom today. We could be in for a nice bull run. I am a little concerned about changes to the tax code next year upsetting the apple cart this fall.

If the market wants to go up, great. It’s easier making money on the long side anyways.

I’m not trading a trillion dollar portfolio. I can exit the market and go the other way pretty quickly. 🙂