Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed with a bullish bias. Europe is currently up across the board. Futures here in the States point towards a gap up open for the cash market.

There are many people calling yesterday’s low THE low for the near term and expect prices to move up from here. I’m not against the idea. The charts don’t look too encouraging, but trends fall into different stages – new, established, mature. The downtrend has reached maturity which doesn’t guarantee it’ll reverse, but it does tell us the risk/reward for entering new shorts is not favorable. So now is the time to play good defense. If you’re a short term trader, you’ve already taken profits on shorts. If you’re a longer term trader, you’re committed to holding through a bounce. Either way works – just don’t be middle of the road.

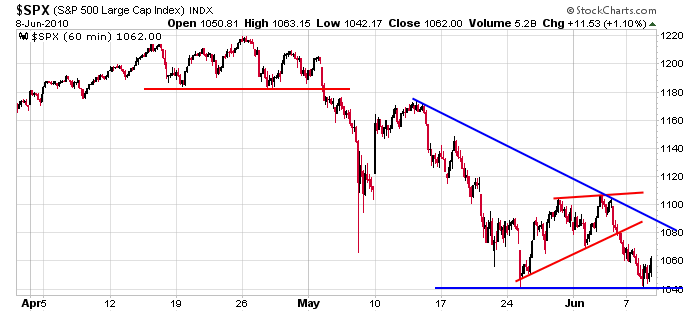

Here’s the 60-min chart. It broke down from a small rising wedge last week and thus far has held its low.

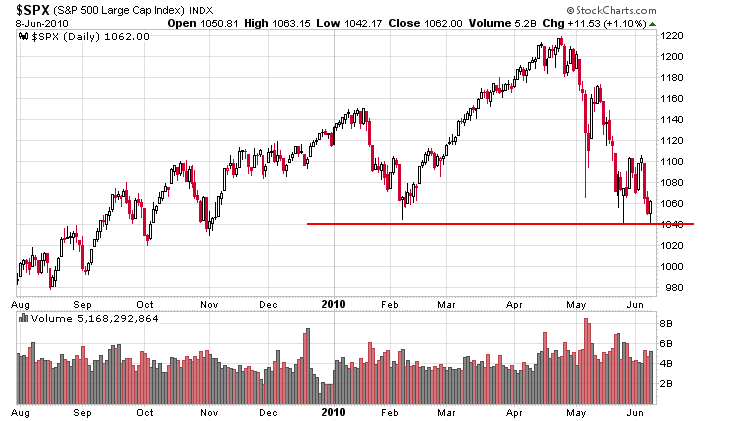

Backing up, here’s the daily. It also held its Feb low, so again, we don’t know what will happen, but we can recognize the downtrend as being mature and not conducive to initiating new shorts.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 9)”

Leave a Reply

You must be logged in to post a comment.

How do you define short term and long term investor?

s&p failed to hold 1063— I think we have already had our bounce and now we head to 960