Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Europe is currently mostly up. Futures here in the States point towards a moderate gap up open for the cash market.

Lots of traders thought Tuesday’s successful test of the previous low and close at the high would be enough to fuel a little move up, so the market did what it likes to do – tease them a little and then make them wrong. The market was strong early and then gave everything back. Today another attempt will be made.

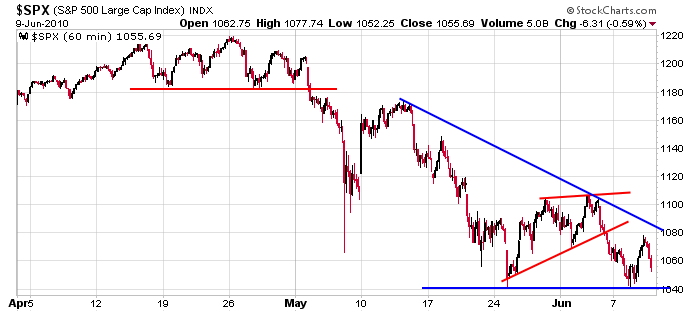

Here’s the SPX 60-min chart again. The bear wedge played out nicely but the previous low held. The overall trend is down, and it could be argued a descending triangle is forming. My experience with them tells me not to get excited about the downside if support is taken out because at least half the time the pattern morphs into a bull wedge and a rally follows.

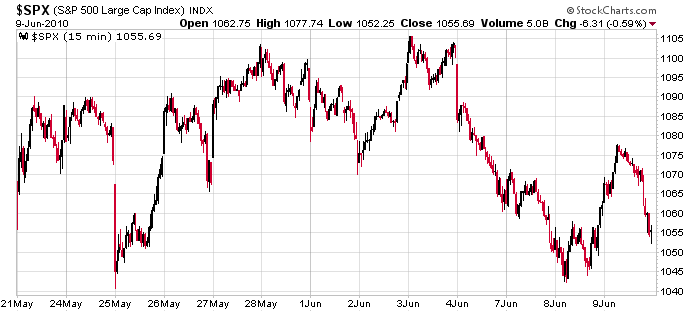

And here’s the SPX 15-min without any trendlines. I like to look at this kind of a chart from time to time to remind myself the market spends more time chopping and churning than it does trending. As of today’s open, the index will be approx. unchanged over the last three weeks.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

3 thoughts on “Before the Open (Jun 10)”

Leave a Reply

You must be logged in to post a comment.

“and what to my wondering eyes should appear” A gap up on the open. This market is wierd!