Good morning. Happy Monday. Hope you had a nice weekend.

The foreign markets have gotten the new week off to a great start – every index is up, and there are many 1% gainers. Futures here in the States point towards a relatively big gap up open for the cash market. This comes off the two best consecutive open candles since the April top. The market has had a hard time rallying on consecutive days and rallying after a gap up, so last Thursday and Friday’s movement is encouraging for the bulls.

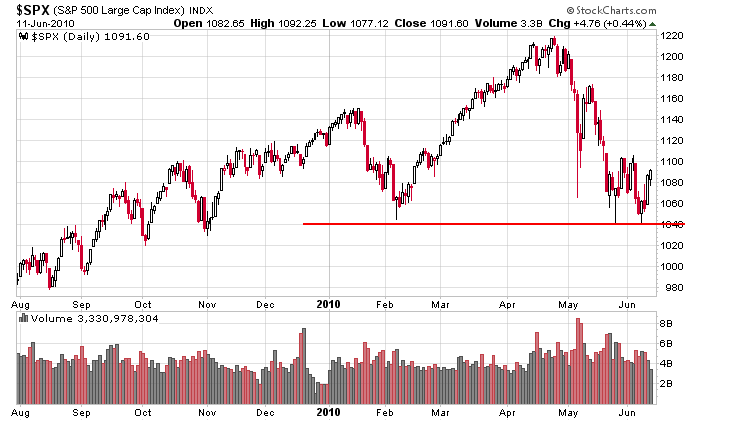

I don’t have much to add to my weekend report. The trend off the April high is down, but short term things are neutral. I saw much improvement at the end of last week – enough improvement to make me take notice but not enough to get me super excited. The market has done a great job digesting a lot of bad news lately, so if that news flow subsides, a positive boost is coming. Volume at the end of last week was however very light – a slight concern.

Here’s the daily SPX. Several countries in Europe would be going bankrupt if not for being bailed out, and all the market could do was drop to its February low. That’s not too bad, is it? More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

3 thoughts on “Before the Open (Jun 14)”

Leave a Reply

You must be logged in to post a comment.

what does current option pain tells you today?