Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Europe is currently up across the board, but gains are small. Futures here in the States point towards a gap up open for the cash market.

All the indexes traded up to 4-week highs yesterday…they’ve been on a nice run the last 7 days. Lots of bad news has been absorbed, so it’s a positive sign for the bulls to be able to hold the line and push things up recently.

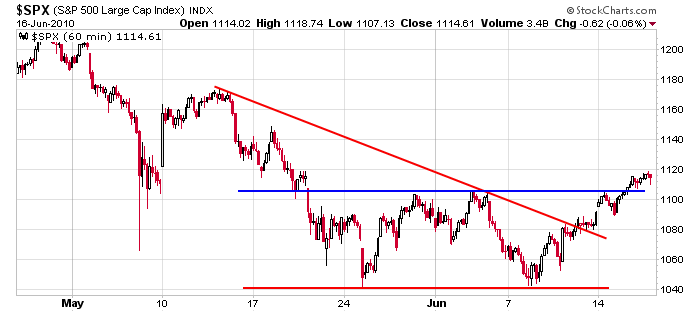

Here’s the SPX 60-min. Two trendlines have been cleared, but we are far from being “in the clear.’ The index has come a long way in a short period of time and still has lots of overhead resistance to deal with. So far, so good, but there’s work to be done.

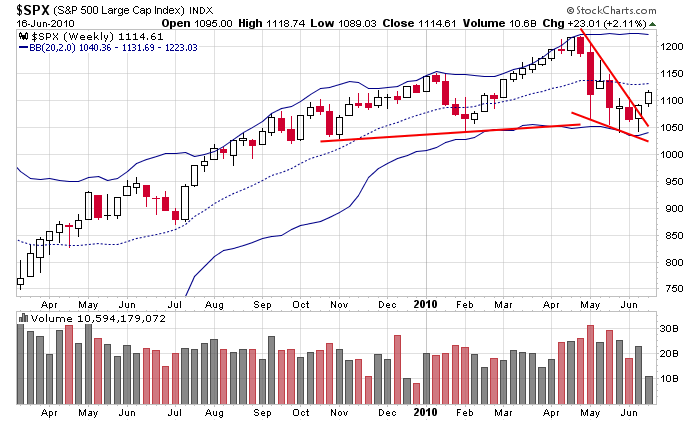

Backing up, here’s the SPX weekly. The lower Bollinger Band acted as support and then the index broke from from a falling wedge. This overall picture doesn’t look too bad, so again, the market has done a good job absorbing all the bad news from Europe.

The charts are much improved, but I’m not yet convinced we’re about to begin a new leg up. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

2 thoughts on “Before the Open (Jun 17)”