Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Europe is currently mixed with an upward bias – there are no big movers. Futures here in the States point towards a flat open for the cash market. This comes off a day where the indexes close approx. where they opened and at the end of a second consecutive up week – the first back to back up weeks since early April.

When the week began, the indexes needed to move up a little to cause more pain among option traders. Barring a total collapse today, I’d say that mission has been accomplished. The bears bet big again, and they lost again.

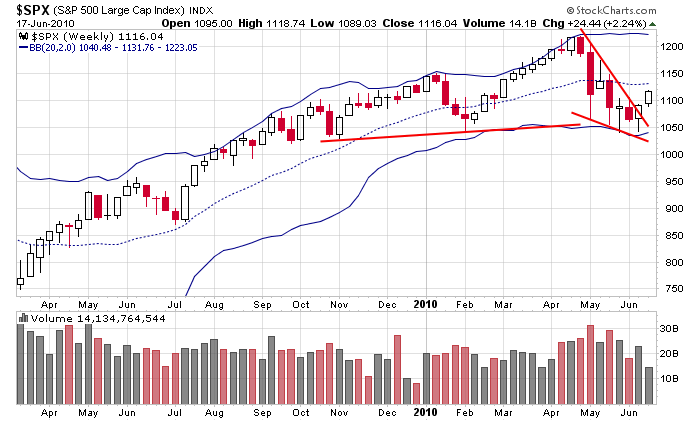

The SPX weekly continues to look pretty good. The previous low held, and then the index broke out from a falling wedge.

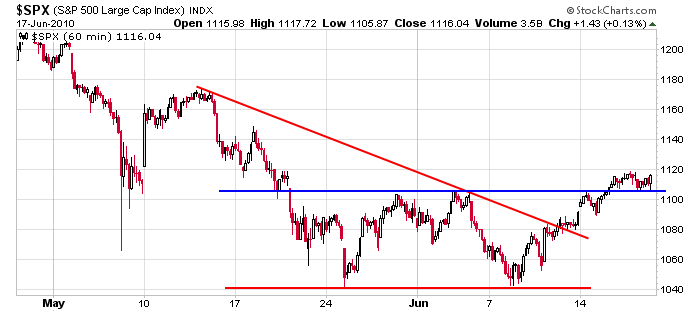

Zooming in, the SPX 60-min chart looks constructive. It formed a 4-week base, moved above resistance, and as of now, resistance has become support.

How long can the recent strength last? I have no idea. I don’t make predictions. Right now the charts lean to the upside, so I’m sticking with that side of the market. When the charts change, I’ll change. I’m not one to argue with the market. It’ll be interesting to see how the indicators changed considering we’ve now had two solid up weeks.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

2 thoughts on “Before the Open (Jun 18)”