Good morning. Happy Tuesday.

The Asian/Pacific markets closed down – there were a couple 1% losers. Europe is currently down across the board – half the markets are down 1%. Futures here in the States point towards a down open for the cash market.

Many ugly candles were formed yesterday by the big gap up and subsequent all-day selling pressure. The question now is is the move off the Jun low over or was yesterday just weak day coming off a 2-week move which rallied the S&P almost 9%. Nobody ever knows the answers to these questions until after the fact. Our job is to get a sense of the odds and play accordingly. If you’re a shorter term trader, yesterday’s gap up was a great opportunity to take profits. If you’re an intermediate term trader, you’d give the market a little room to move against you (if you want to ride the bigger waves you have to be willing to sit tight). What you do mostly depends on what your DNA will allow you to do.

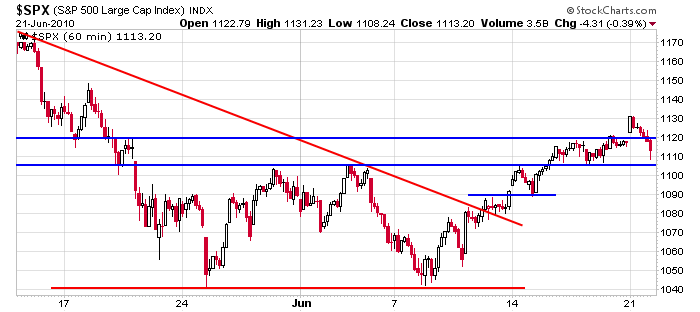

Here’s the 60-min chart. A double bottom formed…then it took out the middle hump (supposedly this is needed to confirm the double bottom)…now we’ll see if former resistance levels turn into support.

I’m going to post some short set up ideas on the message board just in case the market moves down for several days.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

4 thoughts on “Before the Open (Jun 22)”

Leave a Reply

You must be logged in to post a comment.

Where’s lier, lier the put buyer?

Baggy Pants day. Not sure what’s holding them up.