Good morning. Happy Wednesday. Happy Fed Day.

The world markets are mixed. Futures here in the States points towards a positive open, but this isn’t saying much after yesterday’s stiff selling pressure.

Today at 2:15 EST the FOMC will announce their target for overnight rates. No change is expected, and since we’ve had several FOMC days where nothing was done and the language in their statement barely changed, more of the same is expected. We’ve also been getting muted reactions to the Fed lately. Personally I think they should move rates up so when the next shoe drops, they’ll have some dry powder, some ability to lower rates to at least improve the psychology of the market.

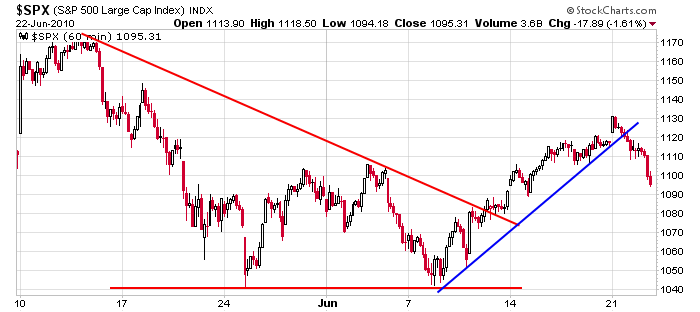

The market needs to move up soon. After the S&P rallied 9% in less than 2 weeks, giving some back is fine, but the market can’t fall too much or this correction within the mini uptrend will turn into a leg down.

The charts are less clear now in the short term. We got a breakout from some falling wedges and some follow through, but now prices are hanging out in no-man’s land. Here’s the SPX 60-min. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

4 thoughts on “Before the Open (Jun 23)”

Leave a Reply

You must be logged in to post a comment.

Do you really think this market would turn around on a half point? Personally, I think the Gov’ment should stop printing money and start printing jobs.

I wish they would have stopped printing money long ago. All this government intervention only prolongs the inevitable. JMO