Good morning. Happy Friday.

Overseas markets closed mostly down. Futures here in the States point towards a small gap up open for the cash market.

Today is re-balancing day for the Russell. They rank all stocks by market cap. The top 1000 become the Russell 1000, the next 2000 become the Russell 2000 etc. The Russell Group doesn’t hand pick stocks like the Standard & Poors does; everything is mechanical and by market cap. There will be Russell 1000 stocks that become Russell 2000 stocks and vice versa and Russell 2000 stocks which drop out all together. Tracking funds and ETFs will need to do lots of buying and selling to be in line with each index’s components…although I’m not sure if they all have to accomplish the re balancing in one day.

The market is on a 4-day losing streak. This has happened several times the last year, but you have to go back to the March 2009 bottom to find a 5-day losing streak.

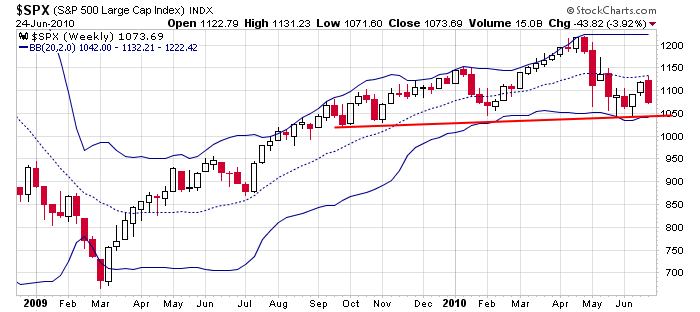

Barring a huge rally today, bearish engulfing candles will be completed on the weekly index charts.

Support for the S&P is in the 1040-1050 area, but I don’t like to drawing lines in the sand. If this area gets taken out, it doesn’t automatically mean the market is going to fall apart. Often key levels get taken out, traders line up on one side of the market and then the opposite move happens.

That’s it for now. I expect lots of volume and random price movements with it being Russell re-balancing day.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 25)”

Leave a Reply

You must be logged in to post a comment.

vooop voooooooop 😉

Voop Voooooooooooop, is that a buy or sell signal?

Personally, I don’t think they buy or sell anything, but keep separate books. They only have to redeem at index value. If market timing is impossible then how can a fund match an index within 98%? I asked that of Vogal and he never replied.