Good morning. Happy Thursday.

The world markets are down – there are several 1% losers. Futures here in the States point towards a moderate gap down open for the cash market that will open the indexes below yesterday’s low.

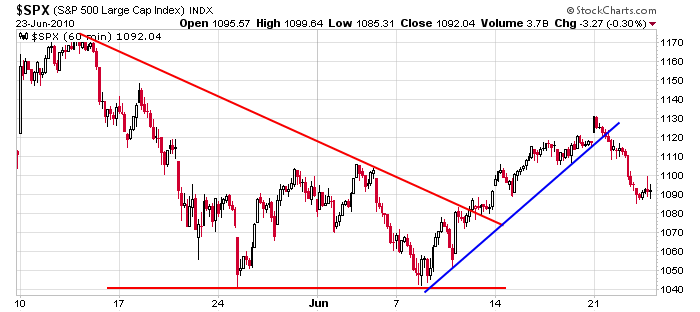

Here’s the SPX 60-min chart. If the futures don’t change by the opening bell, the index will open in the middle of its recent range – half the 2-week rally will have been given back. Such a pullback isn’t desirable, but it is acceptable.

As I stated yesterday, I don’t see a clear path right now. I can make a case for higher prices, but there’s lots of overhead supply to contend with. I can make a case for lower prices, but we can’t expect too much follow through given the late-May and early-June lows being fairly strong. Right now is not the time to be aggressive. Let the market show its cards before trading actively again. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

4 thoughts on “Before the Open (Jun 24)”

Leave a Reply

You must be logged in to post a comment.

“Such a pullback isn’t desirable”.. Sounds like you have a long bias.. why?

I was speaking from the standpoint of what should happen if the uptrend off the low from 2 weeks ago was to continue…that if the market was strong, it shouldn’t give back much more than half its gains.

This is not being bullish. I’m talk from both sides of the tape, and in this case I was talking from the bulls perspective.