Slow day…not worth analyzing. Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

SPY (closed 108.03)

Puts out-number calls more than 2-to-1, so bearish sentiment not only remains high but expanded from last month.

Call OI is highest at 100 and tapers down on both sides of this strike.

Put OI is highest from 110 all the way down into the mid 90’s.

There’s some overlap in the 108-110 area, but since puts far out-number calls, let’s focus on those to determine where price needs to close Friday to cause the most pain. The biggest put spikes are at 105 and 107, and OI at 108, 109 and 110 is very heavy too. A close at 110 would cause lots of pain, but a little lower than that would be fine too. With SPX closing at 108.03 today, a flat to up market the next couple days would accomplish the mission.

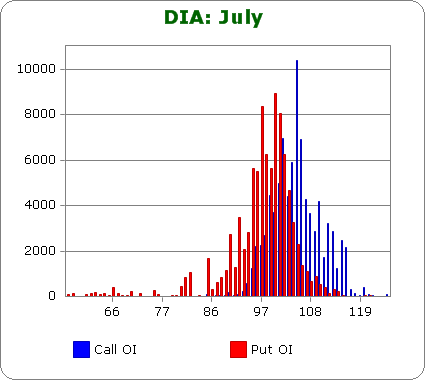

DIA (closed 102.25)

Puts outnumber calls about 1.5 to 1 – this is a departure from previous months when, even when the trend was down, calls and puts on DIA were typically equal.

Call OI is highest between 102 & 106.

Put OI is highest between 95 & 102.

The two zones meet at 102, so it’s easy to say a close there would cause the most pain. DIA closed today at 102.25, so flat trading the rest of the week would do the trick.

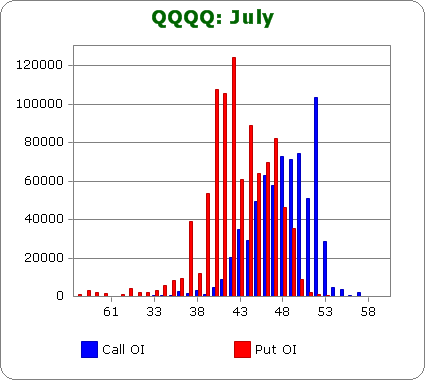

QQQQ (closed 44.75)

Puts out-number calls by 1.5-to-1.

Call OI is highest between 46 & 52.

Put OI is highest between 40 & 47.

There’s overlap between 46 & 47, and with today’s close at 44.75, a little upside movement is needed the next couple days to achieve max pain.

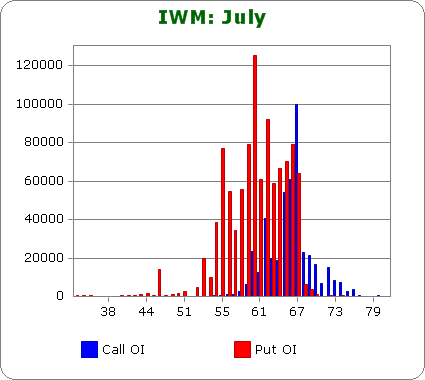

IWM (closed 62.23)

Puts out-number calls by 2.6-to-1.

Call OI is highest 65-67.

Put OI is highest between 55-67.

There’s some overlap at between 65 & 67, but since puts dominate, let’s focus on them. A close at 67 would cause most puts to expire worthless. The stock closed at 62.23 today, so as it stands now, some put buyers will make money this option cycle. A decent move up is needed.

Overall Conclusion: The bears continue to trade in anticipation of a big move down and as of today’s close, they’ll scratch their SPY, DIA and QQQQ trades and make a couple bucks on their IWM trades. A continuation of mini rally we’re in would cause more pain, so if the invisible hand of the market were to move to frustrate the most number of traders, the market would continue to move up the next couple days.

0 thoughts on “Using Put/Call Open Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

great work thanks

And should be a dull week as there’s not much news!

Thanks for monthly maximum pain info.

Jason:

Where do you get these histograms from?

Bob, they come from here…

http://www.schaeffersresearch.com/streetools/indicators/open_interest_configuration.aspx?ticker=