Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Europe is up across the board with solid gains. Futures here in the States point towards a moderate gap up for the cash market thanks to good earnings from AA despite Portugal being downgraded.

The S&P has moved up 5 consecutive days – the last two on very light volume. Now we get a gap up, and unless something is changing about the market, this vertical move off last the Jul 1 low isn’t sustainable.

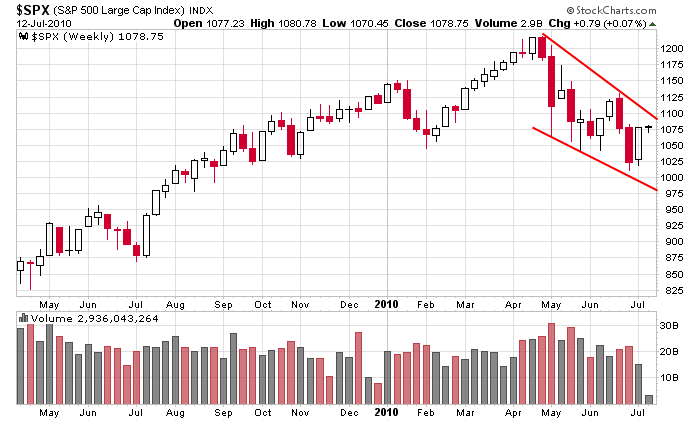

Here’s the weekly. Resistance is at 1100ish…plus we have the Jun high to contend with. Given the straight up move and overhead supply, this isn’t a time to be aggressive on the long side.

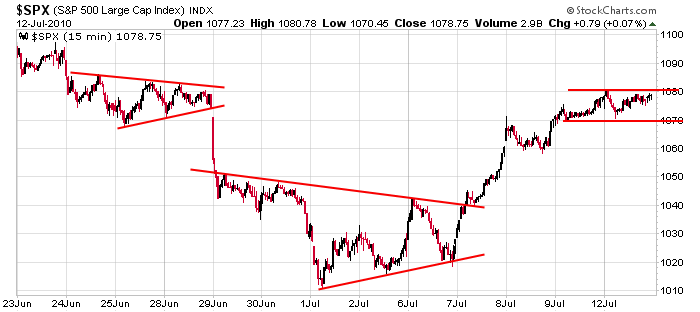

Here’s the 15-min chart. If today would have been a quiet day, I’d say the market was well set up for a breakout and quick move to 1100, but the gap up diffuses any pent up energy.

I don’t see many great set ups right now. This is a good time to work on yourself so you’re more ready for the next batch of trades.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 13)”

Leave a Reply

You must be logged in to post a comment.

“If today would have been”.

I think you mean “If today had been”.

Your English teacher would have given you a nasty crossout, lol.

Hey cut an engineer some slack 🙂

“. . .this vertical move off last the Jul 1(?JUN 28?) low isn’t sustainable. “

The low was put in place Jul 1, right?

What’s your time horizon….very important.

Watch the $SPX Daily Full Stochastics. They are reaching

overbought territory. I think it will be a good place

to go short, maybe in the next day or so. HW

Howie, haven’t you heard the dow is headed for 12000 or higher