Good morning. Happy Thursday.

The Asian/Pacific markets closed down across the board – there were a few 1% losers. Europe is currently mostly up – movement is very small. Futures here in the States point towards a gap up open for the cash market.

The S&P’s winning streak is over, but it’s not like the floor fell out yesterday. In fact I’d say yesterday was a pretty good day – to only fall a tiny amount given the rally off the low is a good performance, a performance which hints the bulls are not eager to take profits but instead still looking to buy.

This bounce is starting to feel like the beginning of a move up, not a bounce within a downtrend. A rest is needed, perhaps some backing and filling, but I expect to see higher prices. I know it doesn’t make sense, but that’s exactly why it might happen. Because nobody thinks it can.

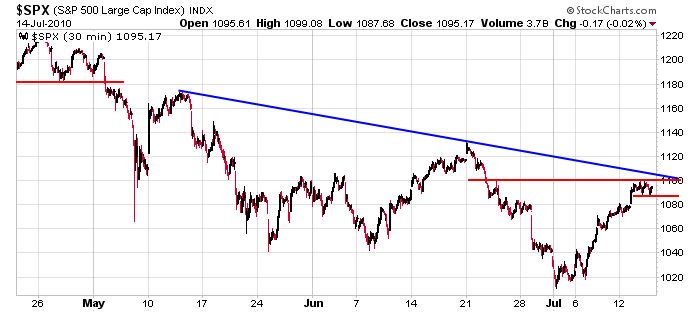

Here’s the SPX 30-min. Resistance at 1100 is just overhead, and on a longer time frame, lower highs and lower lows remain in place. This of course will need to change if we’re to have a trend reversal. But the first step has been accomplished, namely positioning the market for an attempted breakout.

A few new set ups were posted last night. This too is a good sign – that some playable chart patterns are starting to form.

Things are looking better, but the market still may need to rest. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 15)”