Good morning. Happy Wednesday.

Yesterday we got an earnings induced gap up from AA. Today we’ll be getting a small earnings induced gap up from INTC. The market has moved up 6 consecutive days without taking much of a breather – a streak that can’t last too much longer without a rest or some backing and filling. But let’s not get too detailish with the day to day movement because anything can happen from one day to the next. The bigger question is whether the recent action is just a bounce within an downtrend or a the beginning of a leg up. I’ll be talking about this after today’s close. A couple days ago I would have argued this was a bounce within a downtrend, but evidence is building that this is a little different.

The Asian/Pacific markets closed mostly up; Europe is mostly down.

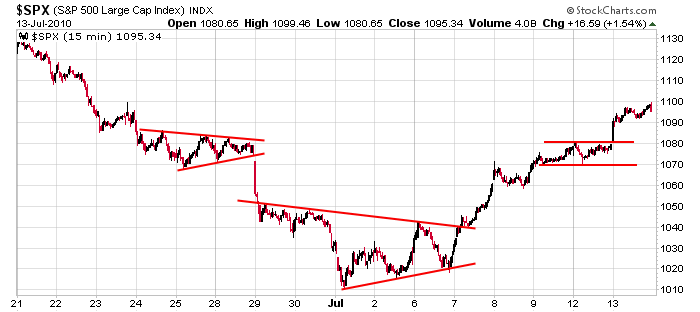

Here’s an update of the 15-min chart. It’s less evident here the market dropped 9 of 10 days, and is now on a 6-day win streak. We’re getting close to a crossroads. The move up isn’t sustainable. How shallow or deep will a pullback be?

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 14)”

Leave a Reply

You must be logged in to post a comment.

Jason, thnx for your daily “before the open” blog…i find it really informative and appreciate it very much. Keep it going!

Thanks gc 🙂

Personally, I’d like to see a higher-low(EOD) as a trend change indication.

“The move up isn’t sustainable. How shallow or deep will a pullback be?”

I could not agree more and I am not bearish.

neal, don’t forget that blog 2 days ago, who cares for this week, this is opx expiry, from what jay was saying is that we’ll probably do the most pain staying pinned right here till friday.

A few days ago I would have said the move looked like a bounce within a downtrend. Now it’s looking more like the beginning of a move up.

Yes I am permitted to change my stance. Only an idiot would stick to his guns in the face of a changing market.