Good morning. Happy Friday. It’s options expiration day.

The Asian/Pacific markets closed mixed with a bearish slant; Japan dropped almost 3%. Europe is currently mixed and without any big movers. Futures here in the States point toward a flat open for the cash market.

Overall it’s been a pretty good week. The S&P is up 18.5, but most of those gains were registered on a single day – Tuesday. And much of Tuesday’s gains came in the form of a gap up.

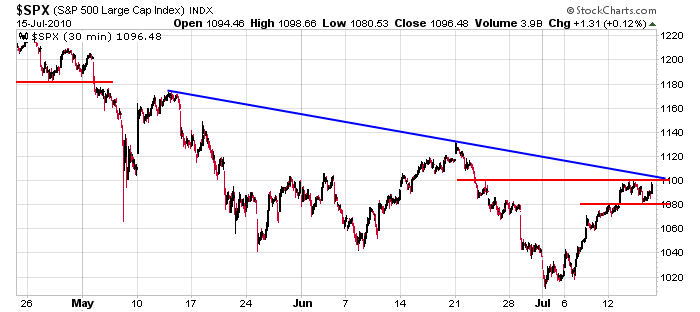

The S&P has established 1100 as short term resistance (see red trendlines below) and intermediate term resistance (see blue lines below).

The market is setting up for another move up, but there are a couple headwinds that we need to be aware of (besides those trendlines). Earnings season kicks into full gear. News trumps the charts, so no matter how good the short term looks, it can change fast. Also, more times than not, the market has moved up into options expiration and then sold off afterwords – something to look out for next week. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 16)”

Leave a Reply

You must be logged in to post a comment.

Boy, you sure did miss this one. Asian markets down, GOOG missing earnings and on and on.

I can see the 500 pausing at 1088 and testing 1082 today perhaps, but up is not in the cards for this morning anyway.

forward looking comments for sure Gary, we were down big today.

“The move up isn’t sustainable. How shallow or deep will a pullback be?”

Great call!

I am still wondering about this one!