Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly down. Europe is mostly up. Futures here in the States point towards a positive start to the new week.

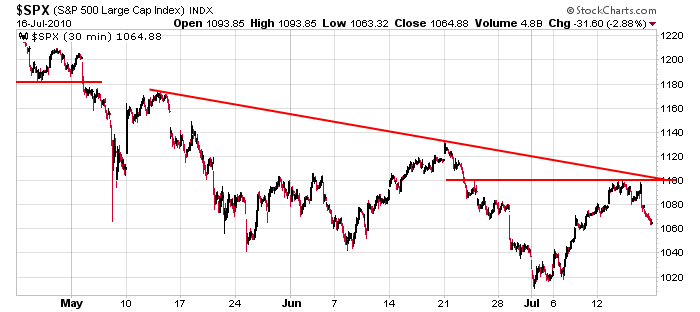

Last week the S&P rallied right up to resistance at 1100 before taking a big hit on Friday.

Earnings season has been so-so. AA gave back all its earnings-related gains and then some. INTC has fallen back to its post-earnings gap level. GOOG got clobbered after they missed estimates. Companies that have done well have been rewarded in the near term, but those gains aren’t holding. Companies that miss are taking hits.

More times than not the last year the market has rallied into options expiration and then sold off…something to keep in mind.

Also the market has been very trendy the last few weeks. First it rallied 5 of 7 days…then it sold off 9 of 10 days…then it rallied 7 of 8 days. Did Friday start a new leg down?

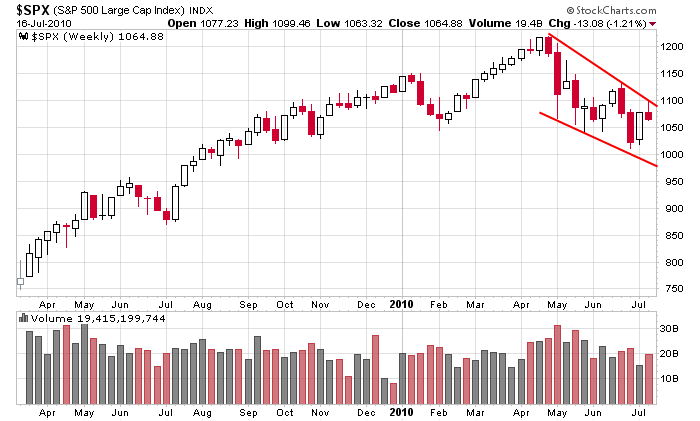

Here’s the SPX weekly. The big picture falling pattern remains in tact.

Here’s the 30-min. The intermediate term trend is down. Lower highs and lower lows are in place. Two trendlines met at 1100 and were too much to overcome.

Long term the market isn’t in bad shape. Short term the trend is down. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 19)”

Leave a Reply

You must be logged in to post a comment.

Hi Neal!

Your request regarding Apple. I think retail is

going to jump on it, but the institutions probably

have it on their sell list.

2.Goldman Sachs will dictate trading for

tomorrow, ‘turnaround Tuesday’ HW

@neal I think now is a good time to hold onto your apple stock as it’s likely to rise in the coming months for the holidays.

Also, look into SWRS; Southwestern Resource Station is a really good penny stock with lots of potential.