Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up – China gained more than 2%. Europe is currently down across the board. Futures here in the States point towards a fairly large gap down open which will open the market below yesterday’s low.

IBM’s earnings came in weaker than expected – the stock is down 5% before the open. But futures were up as of 3 o’clock in the morning, so the weakness isn’t IBM related.

From what I see, the trend toward trending seems to be staying in place. The market rallied 5 of 7 days…then dropped 9 of 10 days…then rallied 7 of 8 days…and now seems to be starting a move down.

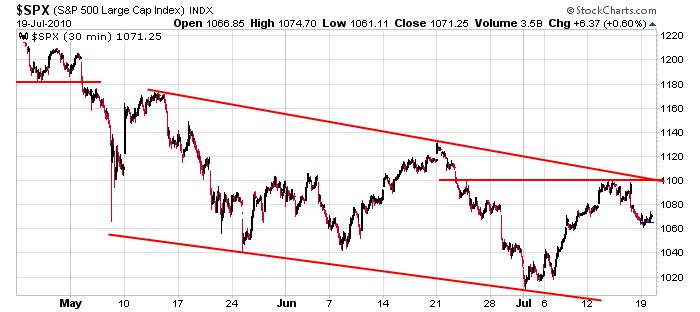

Here’s the SPX 30-min. Lower highs and lower lows mean the market is trending down over the last couple months…but within the downtrend, we’ve had a couple nice upswings to play, and the index is flat over the last 9 weeks. Hence it’s better to play the swings, not go short and wait.

But remember this is earnings season. News trumps the charts, so being aggressive isn’t wise. Today’s gap down will be salvageable, but I wouldn’t want to see it drop too much more. Otherwise a mini leg down will be in place. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 20)”

Leave a Reply

You must be logged in to post a comment.

It wouldn’t take too much effort on the part of the bears

to get the $S&P back down to the 1040 support area.

What I am looking for is a mid-week bounce either Tues or

Wed, and then heavy selling to resume at the end of this week.

Thanks for your comment.

Hi Neal!

Thanks for the trading advice,

‘buy the dumps, sell the humps’

Here’s one for you: Why buy the cow

when you can get the milk for free?

Regards,

HW

My favorite is, “No gas, no grass, no ass, no free rides”

Does Gold lead or lag the S&P or is there a correlation? What good is gold and what does it’s price movements tell me?

Thanks

The rebound today has me baffled. When you have a drop off like Friday the market always drops for a week.

If the Friday drop was a pure options play we could see a nice run from here.

I am long…Friday was a 1-day event. We go higher from here.

Thanks. Still don’t understand the value of gold.