Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed and without any noticeable movers. Europe is currently up across the board – almost every market is up at least 1%. Futures here in the States point towards a big gap up open for the cash market.

The market was doing ok yesterday until Bernanke started to speak. His words directly led to a stiff 60-min sell-off before the market flat-lined into the close. In yesterday’s PM Obs I threw out the possibility the selling was nothing more than a knee-jerk reaction and prices would be recovered. This is exactly what is happening right now. As of today’s open, assuming the futures don’t move much, the market will open near the bottom of yesterday’s early day range. If the level holds, yesterday’s brief selling won’t look much different than a typical post-FOMC move…knee-jerk reaction in the near term but no lasting effect.

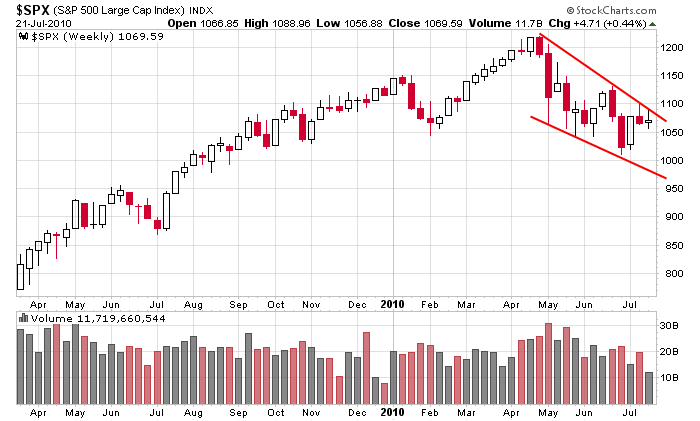

Here’s the SPX falling wedge on the weekly chart. Two relatively small candles that bump up against resistance sets the stage for a breakout.

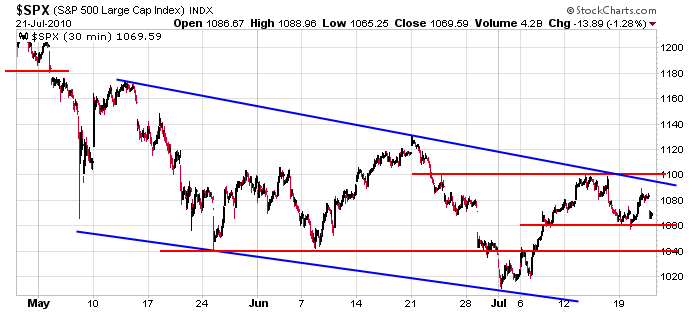

And here’s the 30-min again. Resistance is in the 1090-1100 area, and on any move down, I’d like to see 1060 hold.

More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 22)”

Leave a Reply

You must be logged in to post a comment.

Hi Gang!

I think we will re-visit the $S&P area of 1100

maybe by today or tomorrow, and then that will

represent a triple top. So then it’s every man

for himself regarding the near term future

as to a follow through on the upside. HW

Hi Jason!

Is it possible to have a spell check turned on

every time someone submits a comment? HW

Any word misspelled should have a red squiggly under it. Spell check is automatic these day. If you don’t have it, perhaps your browser needs to be updated.

Can you spell check the market? I think there’s some witchery asunder.