Good morning. Happy Friday.

The Asian/Pacific markets closed up across the board – several indexes gained more than 1%. Europe is currently mixed and without any standout winners or losers. Futures here in the States point towards a moderate gap up open.

It’s been a heck of a week. The market pounded out a bottom Monday and Tuesday morning and then rallied hard Tuesday. Much of the gains were given back Wednesday after Bernanke spoke before Congress, but then all those losses were recovered yesterday. Now the market is sitting at its highest level since last week, and the SPX is well-positioned right below 1100.

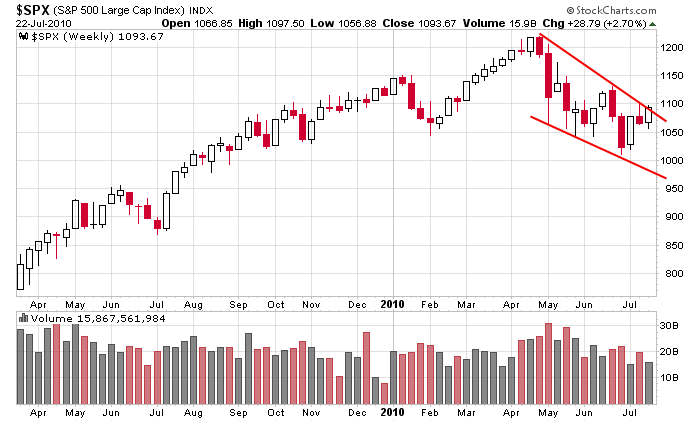

Here’s the weekly. The bullish falling wedge remains in place.

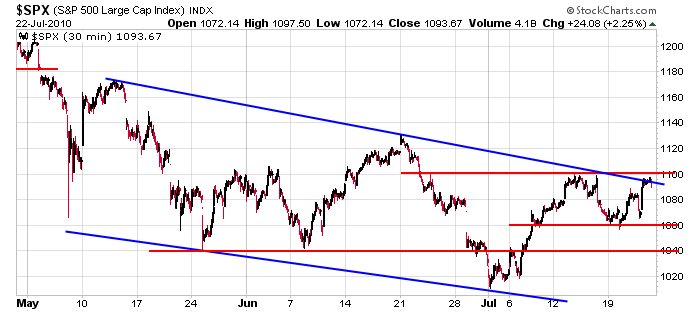

And here’s the 30-min we’ve been using. Unlike the last couple rally attempts, this one has held its gains and not immediately succumbed to selling pressure. I still consider 1100 to be resistance and would consider the pattern in tact as long as 1060 held.

I’m still of the opinion Wednesday’s move down was a short term hiccup and higher prices are coming. My bias remains to the upside, but the S&P has to take out 1100 and hold the level to confirm this. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 23)”

Leave a Reply

You must be logged in to post a comment.

well the instutions have my retirement money. have we got a plan to get it back?