Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up – there were several 1% winners. Europe is currently up across the board – every market is up at least 1%. Futures here in the States point towards a big gap up for the cash market.

The S&P successfully held 1040 again yesterday, and there was some very fishy activity in the futures market right at the close. In less than 2 minutes, over 200,000 contracts traded (normally it would be 20-40K). There was so much buying, the 1-min intraday chart shows a gap. It seems fishy to me. Why would someone wait until the last minute of the day to execute such a big order, and now the market is gapping up big. Hmmm…

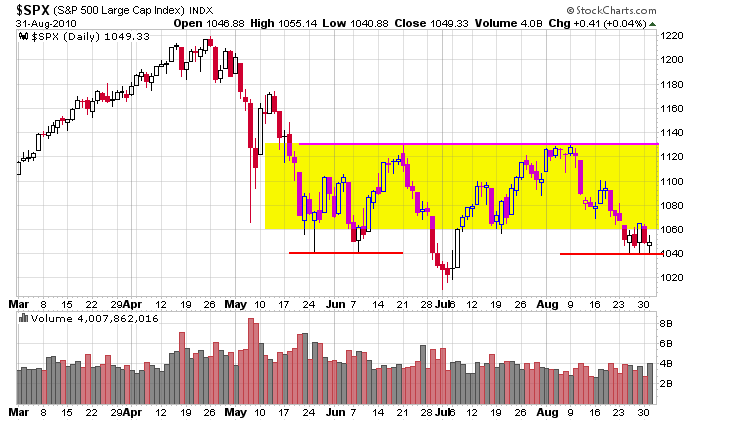

Here’s the S&P daily. Over the last 3+ months the market has been range bound. Over the last week, a bear flag within a mini downtrend has formed. Today’s open will be near the top of the pattern.

Everything is stacked against the bulls right now. There is almost nothing good they can hang their hats on. And this is why the market may surprise everyone and move up. When too many people are stacked on one side, surprises can happen. Be flexible. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 1)”

Leave a Reply

You must be logged in to post a comment.

Last night the futures jumped in anticipation of the President’s speech. It’s up to you to figure out who did all of that buying. HW

I don’t buy that (unless someone somehow got a hold of the speech 2 min before the close).

the hedge funds do not participate in aftermarket hours.

the volume is just too thin. must be someone else. HW

The buying had nothing whatsoever to do with Obama’s speech which was vacuumous at best. It had everything to do with foreign releases and technical buying.

It’s a squeeze but I don’t think it will work, July’s lows are a coming off…covered my short position and watching to see how it plays out. Nice observation Jason.

whats it with the first of the month, does anyone remember how the 1st of August started. Major rally, sideways and then the rest is history.

Turn cycle dates are now in effect! To repeat, they are often identified as the last two trading days of the old month and then the first four or five trading days of the new month.

They are seasonally bullish due to institutional buying and other factors. HW