Good morning. Happy Thursday.

The Asian/Pacific markets performed well today – there were a couple 1% winners. Europe is currently mixed with no standout winners of losers. Futures here in the States point towards a flat open for the cash market. This comes off the market’s single strongest day in at least a month.

The number of S&P 1500 stocks that are trading above their 10-day moving average jumped to their highest number since the end of July. The number above their 40-day MA jumped to a 2-week high. The A/D line was 54:1. As I’ve warned for several days, the bearish side of the market got too crowded, and that mysterious buying in the futures market at Tuesday’s close was a small hint things were about to change.

The obvious question now is: how far this pop will go, and the only obvious and acceptable answer is: I don’t know. Nobody does. Maybe the market goes up a couple days and then sells off to make new lows, maybe the S&P rallies back up to 1130 to test the high of the range, maybe is pushes above 1130 to sucker in more bulls before coming down again. Our job isn’t to guess where it’s going; our job is to trade in the direction it’s moving and play good defense. Right now I’m only interested in the long side, but the market still has some proving to do. It’s got to follow through (preferably early next week).

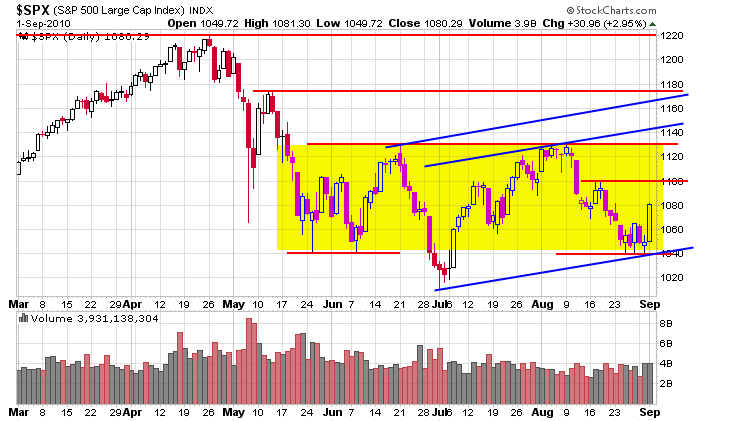

Here’s the S&P daily with a few upside targets. I won’t trade under the assumption they’ll get hit, but the levels do give me a frame of reference to work from. First two upside targets are 1100 and 1130 (both horizontal trendlines). After that the slanted blue lines which are drawn parallel to the lower blue trendline and through prior highs market a couple more levels I’ll be watching if the range can be broken.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 2)”

Leave a Reply

You must be logged in to post a comment.

Sometimes parabolic moves in the market are quickly reversed. However, we are still in

the seasonality bullish sequence, so sideways to slightly ‘up’ is on the menu until we get

out of this time frame. (i.e., keep the pit bull on a tight leash in the yard and then

and let him run loose after Labor Day and let’s see which way he goes). HW

Neal: I recently bought a cocker spaniel named Max. I got him from the ASPCA. Max does all of my day trading for me. He does not like Crox. They don’t have a size that fits him. Not yet, anyway. HW