Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed up across the board – there were several 1 & 2% winners. Europe is currently up across the board – solid gains posted there too. Futures here in the States point towards a large gap up open for the cash market.

Last week the market moved up 3 of 4 days, but volume was light. I said the entire week the bulls had some proving to do, and they still do. I liked the movement, my bias remains to the upside, but given the time of year and proximity to resistance and the lagging small caps, I want proof larger entities are buyers.

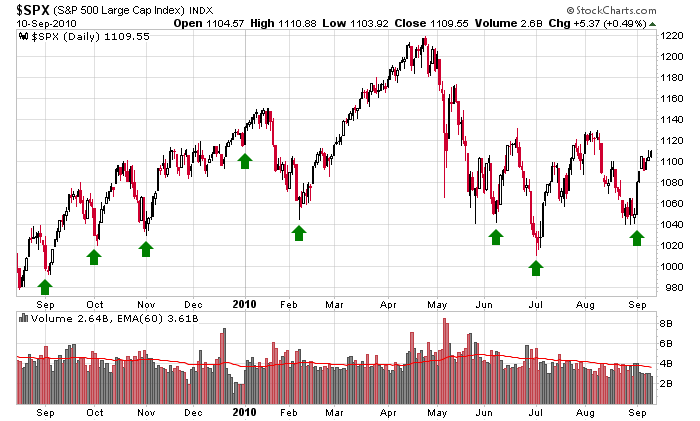

There’s no reason to repost charts from over the weekend, so here’s a different one. Over the last year, there has been a strong tendency to bottom at the beginning of the month and then flatten out or drop near mid month. This month has matched the pattern so far. Options expiration is this Friday. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 13)”

Leave a Reply

You must be logged in to post a comment.

Re: Taxes & Indexes. I believe an index is a 60/40 split. So it has that tax advantage over non index short term trading.

RE: LongTerm vs. ShortTerm tax advantage. The formula is: ((1-TB1) / (1-TB2))-1. “TB” means Tax Bracket. If LongTerm TB is 25% and ShortTerm 30% then ((1-.25) /(1-.30)) – 1 = 7.14%. You’d have to make 7.14% more to break even.

Personally, I don’t care how much I pay in taxes as long as my net is greater.

I use a discount broker. Commissions are less than 1%.

I don’t know what you mean that the 7% can make the difference between winning and losing. The amount of money put on a trade doesn’t change the risk of the trade.