Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

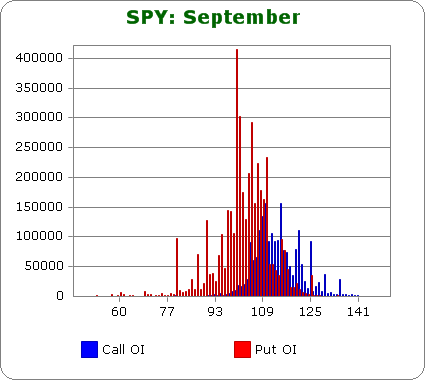

SPY (closed 112.72)

Puts out-number calls more than 2.6-to-1, so bearish sentiment remains high.

Call OI is highest between 108 & 115.

Put OI is highest between 95 & 110.

There some overlap between 108 & 110, but I consider it to be irrelevant. Since put OI dominates call OI, let’s focus on the puts. With SPY closing at 112.72 today, barring a big move down the rest of the week, most of the puts will expire worthless this Friday. Max pain will be accomplished right here or a little lower, so a flat to slightly down market is all that’s needed to maintain this.

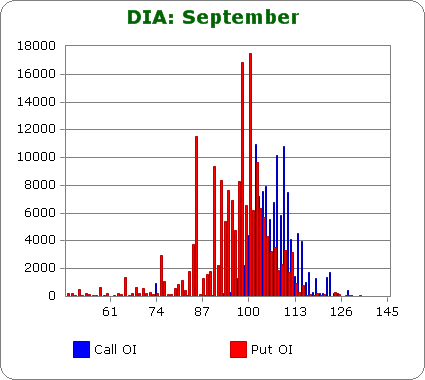

DIA (closed 105.67)

Puts outnumber calls about 1.7 to 1.

Call OI is highest between 102 & 110.

Put OI is highest between 90 & 102.

Like SPY, put and call OI for DIA has little overlap, and today’s closing price is well above the level needed to expire most of the puts worthless. A move up from here would give call buyers some profits, so max pain at the end of the week would require the market to be flat or slightly down relative to today’s close.

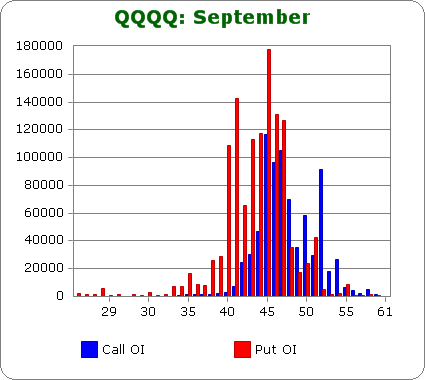

QQQQ (closed 47.25)

Puts out-number calls by 1.6-to-1.

Call OI is highest between 45 & 48 and then there’s a spike at 52.

Put OI is highest between 40 & 47.

There’s definitely some overlap between 45 & 47, and with QQQQ closing today at 47.25, most puts will expire worthless while a few call buyers will make a small profit. A close right here or slightly lower would cause the most pain, so a flat or slightly down market is needed.

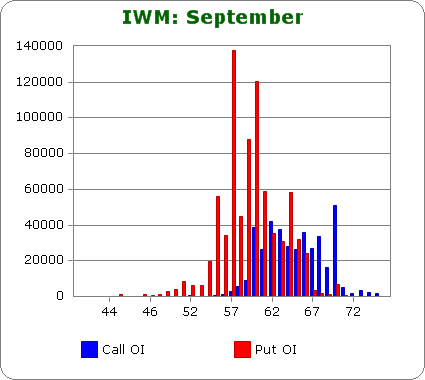

IWM (closed 65.27)

Puts out-number calls by 2.1-to-1.

Call OI is steady between 60 & 67 and then there’s a spike at 70.

Put OI is highest between 55 & 65.

There’s some overlap between 60 & 65, but since puts far out-number calls, let’s focus on those. With IWM closing at 65.27 today, most puts will already expire worthless unless the market falls. A move up will give call buyers a little profit, but that profit will be canceled out by additional put losses. A flat market will cause the most pain.

Overall Conclusion: The market has already move to cause the most pain. In each case above, today’s close was very close to the line that separates put and call OI. A flat market would cause the most pain. Slightly down movement would be fine too. A slightly up market would give call buyers some profits but not much. Basically the only thing that will give option buyers big profits is a big move down, so that becomes the least likely scenario.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

yes, an interesting afterfact about the up move today Jay. Perhaps some profit taking tomorrow after this big move.

thx Jason, u were right on the money last month.

Kayman…I’m not right or wrong…I’m just reporting the numbers as they are. 🙂