Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up – gains were small. Europe is currently down across the board. Futures here in the States point towards a flat-to-down open for the cash market. This of course could change when retail sales numbers are released.

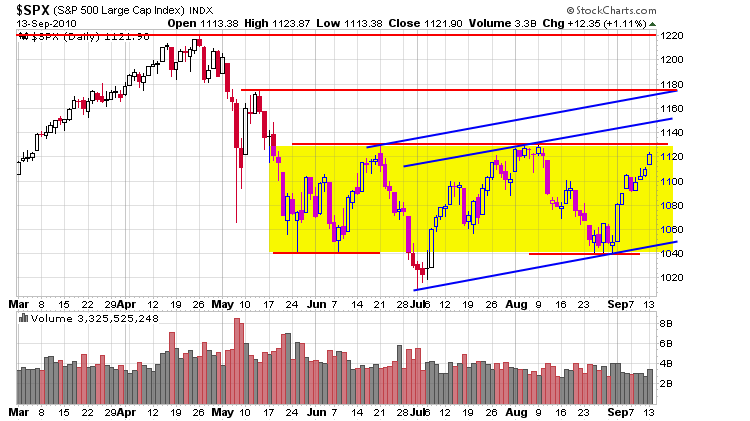

Two weeks ago I said I wasn’t jumping feet first into shorts because there was way too much negativity out there, way too many people stacked on the bear’s side. Since than the market has moved up 8 of 9 days, and the SPX has gained 80 points to put itself within 10 points of the top of its range. Volume has been light, and given the near vertical move, odds favor at least a pause here at resistance.

Here my SPX daily. Upside targets are 1130, 1150 and the high 1170’s.

The banks have improved a bunch the last couple weeks. This needs to continue. The semis have perked up; they’ve been lagging and need to continue to strengthen. The small caps invalidated the negative divergence that had formed at the end of last week – this is a good thing.

My bias remains to the upside, but let’s not get lazy here. The market is still range bound. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 14)”

Leave a Reply

You must be logged in to post a comment.

Can you say Elliott Wave theory? Maybe we’ll see

another pop and drop later this afternoon due to

the fact that we have strong overhead resistance

at or near $S&P 1130. Shalom…peace out..HW

Well if Jay and Howard are right, you take 3 short positions here. 1 @ 1130, 1@1150, and the final @1170. But if that inverted H@S does hold we may see Neal’s dow 12000.