Good morning. Happy Wednesday.

The Asian/Pacific markets traded very quietly and closed mixed. Europe is currently down across the board – losses are moderate. Futures here in the States point towards a small gap down open for the cash market. This comes off a day the market closed down slightly after the FOMC announcement.

The market feels tired to me right now. It took much energy to lift it off the lows of its summer range and get it through resistance. It’s moved up 11 of 14 days and has had to brush off a lot of bad news. It felt tired yesterday. A pullback right now doesn’t mean the uptrend is over and the indexes will settle back into their ranges, it could just be a necessary and healthy evil on the way to higher prices. This has been one of the best September’s on record. The market deserves a break.

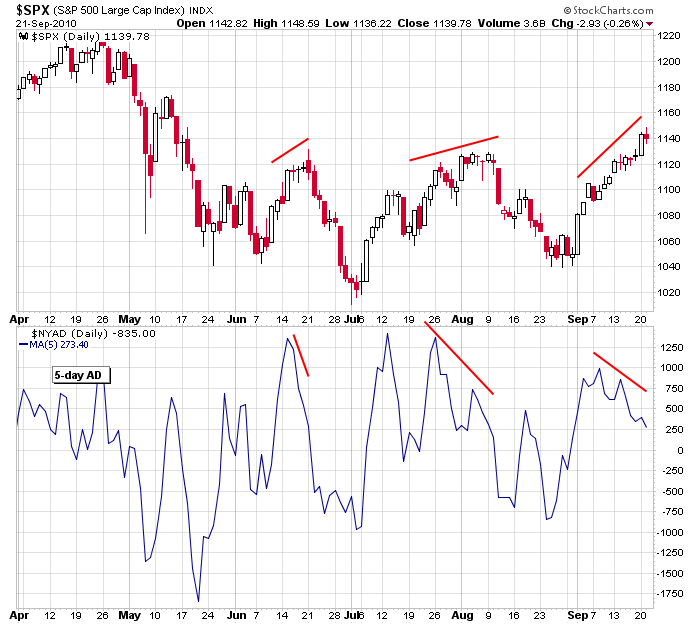

Over the weekend I identified several divergences that were forming and what needed to happen to confirm a move up. The small caps made a higher high Monday to end its divergence, but here’s one that remains in place. It’s the S&P vs. the 5-day MA of the NYSE AD line. While the market pushed to higher highs, this indicator has made lower highs. At first it’s not a big deal because mathematically there’s a limit to how high the indicator can go, but eventually the internal weakness will pull the market down. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 22)”

Leave a Reply

You must be logged in to post a comment.

Hi Jason,

Yesterday the media said the Fed was going to buy bonds and that would raise bond prices and lower bond yields. Question; how does that help the economy?

Thanks

When the gov’t buys bonds, they are dumping money on the system. Plain and simple, there would be more money floating around and spend/invest etc and this has a trickle effect. Beyond this simple explanation, I don’t know. I’m not an economist.

RichE: It’s quite obvious to me that the Fed has very little

left on it’s list of options. In other words, they are getting

kind of desperate at this point. They need to do things just

to show the general public they are making some attempt to

clean up our ailing economy. HW

Hi Howard,

What should the Fed be doing?

#2 RichE : I think the problem with our economy is so pervasive right now it’s beyond the scope of any one man to imagine. I am a firm believer in Elliott Wave theory, and if you

look at some of their charts they make a very strong case for all of the global markets,

(not just ours), to go down as we are still in the middle of a bear market. HW

IMHO the globe needs a half time pep talk and game plan. After all, we (Gov’ment, Corp. and Consumer) are all in the same economic boat.