Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed – there were no standout winners or losers. Europe is currently down across the board – there are a couple 1% losers. Futures here in the States point towards a moderate gap down open for the cash market.

Since about 30 min after the Fed, the market has been moving down. There are some divergences in place (groups and indicators not confirming the higher highs), and by several measures the market is overbought. The first drop off an overbought level is no big deal. The second day of declining prices induces some selling and gets some bulls worried. A third day continues the trend – more selling and even more get worried. At some point the market can cross a threshold, hit an air pocket and come down hard. That is the current risk. A drop off the recent high is not big deal, but at some point the bulls will run for the exits. Play good defense here. I’m not predicting this will happen right now, but we need to take note of the possibility so if it starts to happen, we aren’t entirely surprised by it.

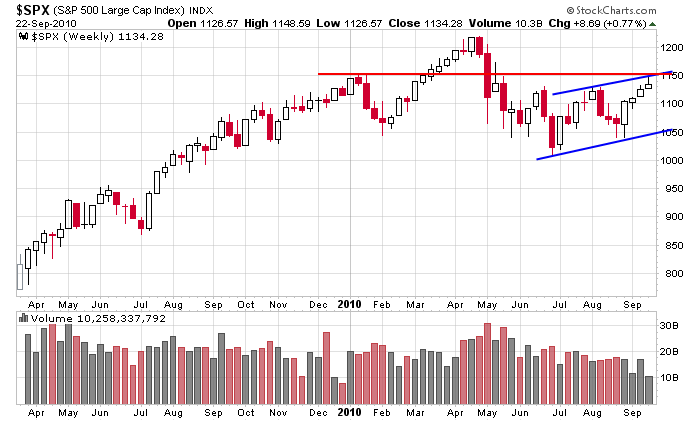

Here’s the S&P weekly. Everyone saw the top of the range. Not many saw resistance at 1150 as I pointed out a couple times last week. Since that level has turned prices back, it’s now a significant level that has to be dealt with. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 23)”

Leave a Reply

You must be logged in to post a comment.

Hi Jason!

You are more likely to hit an ‘air pocket’ on the way down rather than on the way up.

The market tends to gravitate up in stairstep fashion, but when it decides to go

down it does so with a great deal of intensity. I can’t wait for everyone to hit

the exit doors when gold decides to pull back. HW

“several measures”? An elaboration would be nice. What are the measures for Overbought? Of course no one can be 100% but 51% could be profitable. Would you be inclined to post the measures on a daily basis? Perhaps as a group we could refine the process to 51% accuracy. Just a thought. Personally I flip a coin.

Rich…I mostly look at the internals…

advancers vs decliners

advancing volume vs declining volume

bullish % ratios

number of stocks above various moving averages

number of stocks making 10 & 20 day highs

I also just make a judgment call…such that the market has just gone vertical for 3 weeks and needs a rest

Yes, the equities basics, but there are other influencers such as gold, bonds, FX. Years age we could do a good job at guessing based solely on U.S. equities, but I don’t think that’s the case anymore. It seems like these basics are becoming pesticides. The more we use them the more resistant the bugs the less effective the pesticide.

(#1) RichE: If you ask me….I think we’ve had such an amazing runup, that a little bit of a pullback would be in order. If we continue to move much higher in a parabolic fashion (such as we are experiencing right now in gold), a much stronger pullback of greater intensity

should be expected. HW

The 60 day GLD doesn’t look parabolic to me. What is the driver of gold? The driver of equities is growth from earnings.

The driver of equities is growth from earnings. –>>> not in the short term 🙂