Good morning. Happy Friday.

The Asian/Pacific markets closed mixed and without any big winners or losers. Europe is currently mixed with a slight bullish bias. Futures here in the States point towards a moderate gap up open for the cash market that will open the market in the top half of yesterday’s range.

I briefly described a scenario yesterday where the market would grind down day after day and then suddenly hit an air pocket. Again, I’m not predicting it, just mentioning it so if it happens, you’re not surprised by it.

Given that it’s a Friday, the only question on my mind is: who wants to take profits before the weekend. The market has now fallen three straight days. The bulls aren’t worried, but they’re definitely paying much closer attention now than when the week began. If the market shows some weakness, will they say: no way, I’m not sitting in another pullback that tests the lows. Or will the bears who may have shorted on the way up and then again after the Fed meeting realize the market is stronger than they thought, and although a rest is upon us, a move down may not be in the cards. Will they cover? On a Friday I’m tempted to say whoever is more eager to lighten up before the weekend is likely to determine today’s movement.

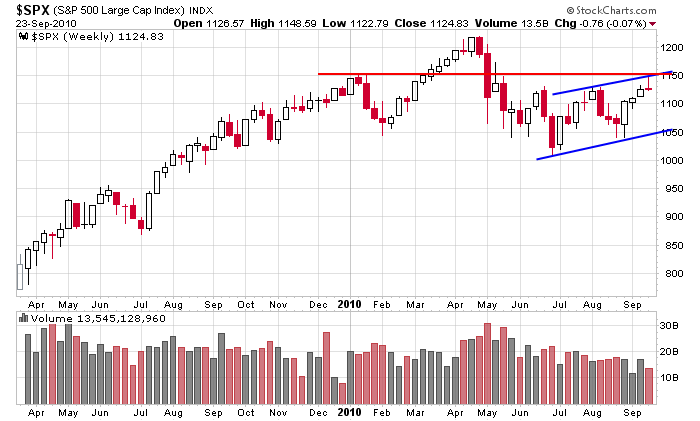

Here’s the S&P weekly. Everyone was looking at the top of the range (1130). I’ve warned to not forget about 1150 because two different trendlines converged there – one from the early Jan 2010 high and one from a trendline drawn parallel to support and through the most recent high in the range. Since this level held, it becomes more significant if visited again.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers