Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed with a bullish slant – there were no big winners or losers. Europe is currently mixed. Futures here in the States are flat.

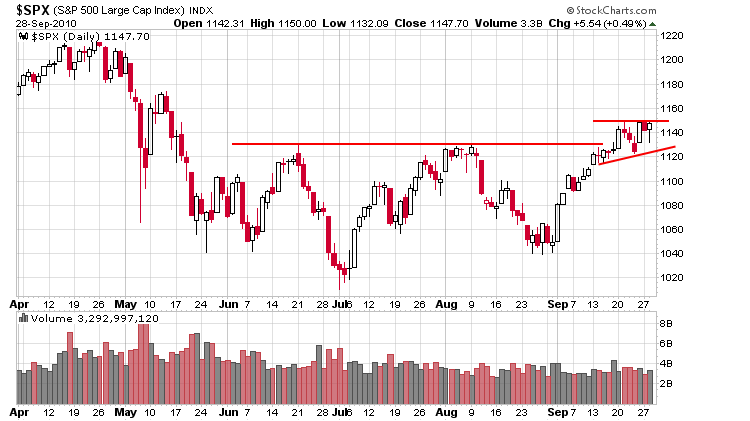

Since moving above the top of its summer range, the S&P has done a whole lot of nothing. We’ve had some gaps in both directions, some intraday swings and in the end the index has traded in a relatively tight range under newly-formed resistance at 1150. Here’s the daily chart. A measured move up takes the index above the April high.

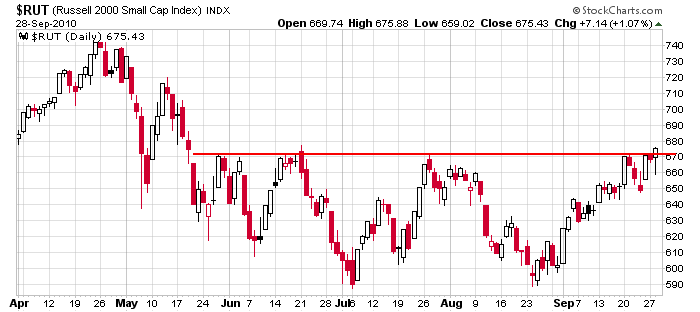

The Russell small caps have also had a great month, but only yesterday were they able to close at a new high. If you’re looking for a divergence, look elsewhere. The small caps are doing just fine.

My stance remains the same. The trend is up, my bias is to the upside. Barring something totally unexpected, there’s a decent chance the indexes can move to the April highs this winter. But in the near term, things seem a little frothy. Bullishness is growing, so the market may need to piss off the bulls a little before legging up again. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 29)”

Leave a Reply

You must be logged in to post a comment.

Jason: The rising bearish wedge you have annotated in your first chart could be construed

as a breakout in either direction. Given the fact that we are now in the traditional

bullish cycle of end of month-beginning of month period, it most likely favors

a breakout to the upside. HW

I pay little attention to those types of historical tendencies. September is supposed to be the weakest month of the year, right? Well not this year…strongest Sept in 70 years. I’m glad I’ve been long all month.