Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed with a bearish lean. Europe is currently down across the board. Futures here in the States point towards a down open for the cash market.

Today is the last day of the month and quarter. Some will tell you the market has a tendency to do X during such times. I pay little attention to such historical tendencies. After all, if I did listen, I would not have been long this entire month.

Yesterday was an inside day (all the movement was contained within the previous day’s high and low), and it was also the first time in 8 days advancers & decliners were approx. equal. The previous 7 days either advancers or decliners led by at least 2:1 – there are many less neutral days nowadays and many more “all or nothing days.” I’m sure there are lots of reasons why, one of them being high frequency momentum trading.

The worst month of the year (Sept) has had its best month since the Great Depression. Logic says it can’t continue, but the market isn’t logical. During the Feb-Apr rally it moved up 9 of 11 weeks. Heading into this week the market had moved up 4 straight. Tacking on several more with an occasional down week would not be out of character – especially in today’s world of government intervention and high frequency trading.

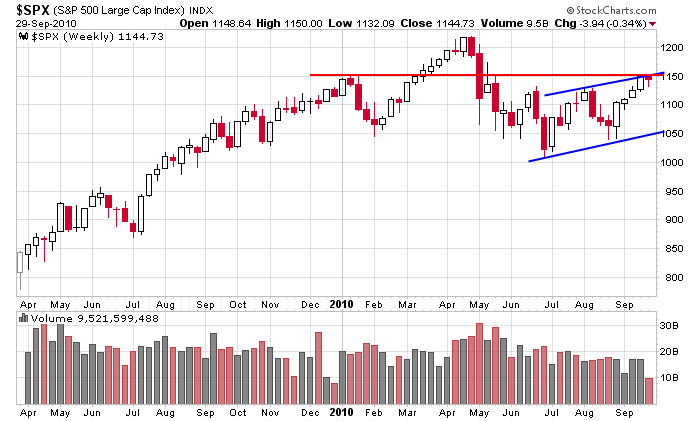

Here’s the current weekly chart. Resistance at 1150 is pretty strong. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 30)”

Leave a Reply

You must be logged in to post a comment.

What are the drivers of the September dip tendency?